Sui Ecosystem Overview

With the recent mainnet launch, Sui Network becomes one of the largest blockchain ecosystems being built, with several hundred projects in development.

Sui Network is a permissionless Layer 1 blockchain that was developed by Mysten Labs. It is designed to provide high throughput and low latency for decentralized applications (dApps) while enabling developers to create unique user experiences tailored for the next billion web3 users.

Mysten Labs, the original contributor to Sui, was founded by former executives/lead architects of Meta’s Novi Research (the team responsible for Diem blockchain and Move programming language)

In this article, we will go through key parts of the Sui ecosystem.

Topics:

- Tokenomics

- Backers and Partners

- Sui Ecosystem

- Summary

1. Tokenomics

$SUI is the native token of the Sui Network. Here are some takeaways:

- The token supply is 10,000,000,000 SUI$, with an initial supply of 5.25%. Worth mentioning that there is no public vesting schedule available for the $SUI token.

- The token will be actively used for ecosystem development with half of the supply being issued for Community Reserve (R&D, grants, delegation programs, and validators)

- The distribution is set to be as follows:

Source: Sui Foundation

2. Backers and Partners

On December 8th Sui announced a Series A round for 36M$ with a16z, Redpoint, Electric Capital, Lightspeed, Coinbase Ventures, Samsung Next, and others.

Later this year, in September, Sui closed a Series B round for 300M$. Investors from earlier rounds followed this round and it was led by FTX Ventures, with the investment being 200M$. However, after the FTX collapse in November, Sui announced that tokens issued to FTX were bought back by the foundation.

In total, Sui Network has raised 336M$ over 2 rounds and is planned to be used on ecosystem development.

3. Sui Ecosystem

Source: SuiEcosystem

Despite being one of the youngest ecosystems, Sui Network is one of the most active in terms of developer activity, with a wide variety of projects being built starting from different NFT collections and ending with DEXes and blockchain infrastructure. Worth mentioning that there are many projects which are already functional since Aptos launch, due to the same programming language

Sui Wallets

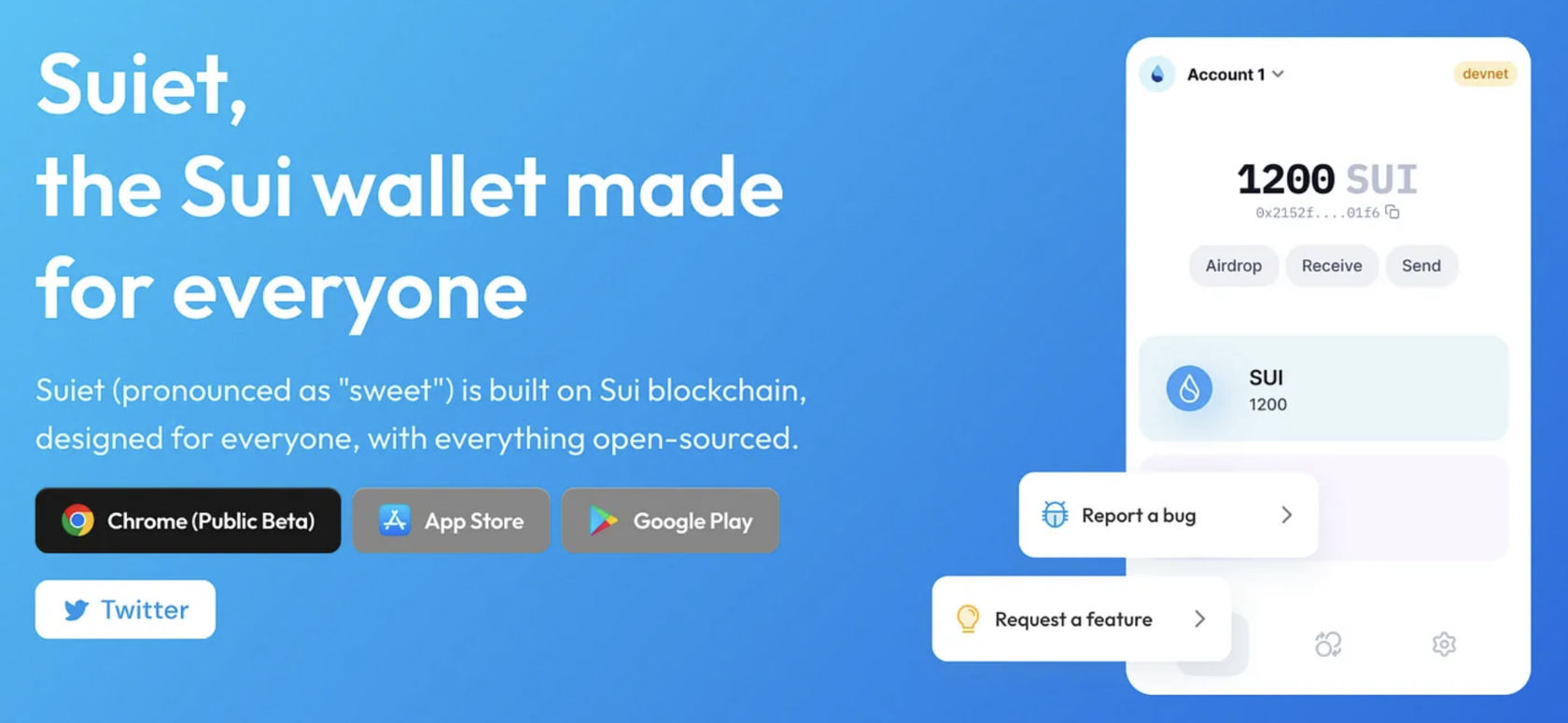

Source: Suiet

- Sui Wallet — is the most used wallet currently, developed by Mysten Labs. Now available as a browser extension.

- Suiet is also, another leading wallet on Sui, with more than 300,000 users already. Also available as a browser extension, the app is in development.

- Another wallet built on Sui is Ethos is already available as a browser extension, and it has already over 100,000 active users.

Sui DeFi

In this section, we will go through prominent DeFi projects in Sui Ecosystem: DEXes, swaps, lending & borrowing protocols, and trading aggregators.

- SuiSwap is one of the most popular DEXes on Sui. It will receive higher traction when the mainnet is integrated into the platform. Turbo Finance- one of the functional DEXes on Sui mainnet with active users.

- The biggest DEX at the moment of this article is Cetus. It is built on Move language and it was available for Aptos earlier. Cetus already has achieved 31M$ in TVL in $SUI.

- Another DeFi platform, which is building on Sui, is Ballast. In Ballast V1, any SUI token can be pooled directly with any other SUI token to create a liquidity pool for trading tokens pair.

Sui Infrastructure

Source: Sui Explorer

Here are some infrastructure projects on SUI:

- MoveBit is a blockchain security company focused on Move ecosystem security.

- There are several naming services on Sui: SuiID, Strock, and Sui Names

- Also, there is a Sui Explorer to track on-chain data and activity.

- Sui doesn’t have their bridges, yet. However, Axelar and Wormhole are developing such solutions for Sui right now.

Sui Launchpads

Source: SuiPad

Due to the high amount of projects in active development, the Sui ecosystem is in need of launchpads, as a staging ground for its growth.

Sui NFT Marketplaces

Source: BlueMove

- The biggest Sui NFT marketplace, for now, is BlueMove. It is operating since Aptos’ launch and was one of the first to launch on Sui Mainnet. In addition, it is a launchpad for upcoming NFT collections on Sui.

- Clutchy is a marketplace for NFTs and gaming. It was one of the first to launch on Sui Mainnet. And several collections are launching there soon.

- Sui ecosystem has a couple of other marketplaces which are worth mentioning. Souffl3 is the NFT marketplace on Move, so it was launched with Aptos mainnet, with great traction back then at the start. And KeepSake is a new Gaming Marketplace launched on Sui mainnet.

Sui NFT

NFT collections are actively developing on Sui, with dozens announced in the following days. Here are some of them

Source: Wizardland

- Wizardland - a sui NFT project inspired by one of the MMORPG games with a fantasy the creators of wizardland sparked an idea to make this project.

- SuiFren Capy - a collection of generated Capys. Achieved 30K $SUI in trading volume.

- Cheapskates - a 3333 collection that focuses on the idea that being ungenerous is the way of being wealthy.

- Occult — an 8888 collection from Occult Labs with more than 100k followers on Twitter.

4. Summary

Sui Network has a decent temp of ecosystem development in each niche. After achieving great results at its launch Sui has many active projects including wallets, DeFi platforms, infrastructure projects, launchpads, and NFT marketplaces. Notable projects include SuiSwap, Cetus, and BlueMove. Many NFT collections are also being developed on Sui. Since the ecosystem is in its early stages of development, investors can benefit from actively engaging in leading ecosystem projects, which may qualify them for potential future retrodrops and yield profitable returns.