Introduction:

Since the launch of Bitcoin in 2009, the concept of decentralization has become increasingly popular. Nevertheless, Bitcoin was not the first decentralized system, Satoshi Nakamoto was the first to successfully create decentralized money, an innovation that gave anyone anywhere in the world open access to a monetary network that used a scarce currency. By both design and community spirit, Bitcoin remains the most decentralized network in the world, but Bitcoin remains primarily a monetary network, not a composable smart contract platform.

The lack of composability of Bitcoin has led to the creation of new networks with different priorities. For instance, Ethereum allows you to create smart contracts that “live” on the network. Ethereum puts additional load on full nodes, which in turn causes some centralization, but it also opens the door for decentralized application layer innovations, which have greatly expanded the design space on the network.

Since the launch of Bitcoin in 2009, the concept of decentralization has become increasingly popular. Nevertheless, Bitcoin was not the first decentralized system, Satoshi Nakamoto was the first to successfully create decentralized money, an innovation that gave anyone anywhere in the world open access to a monetary network that used a scarce currency. By both design and community spirit, Bitcoin remains the most decentralized network in the world, but Bitcoin remains primarily a monetary network, not a composable smart contract platform.

The lack of composability of Bitcoin has led to the creation of new networks with different priorities. For instance, Ethereum allows you to create smart contracts that “live” on the network. Ethereum puts additional load on full nodes, which in turn causes some centralization, but it also opens the door for decentralized application layer innovations, which have greatly expanded the design space on the network.

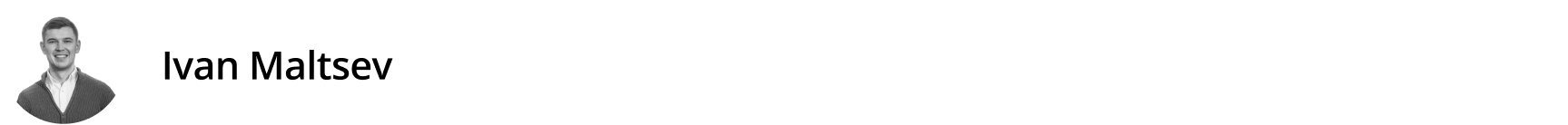

This design choice, sacrificing some decentralization in order to add more features, illustrates a blockchain design framework known as the scalability trilemma, which was first described by Ethereum co-founder Vitalik Buterin. The trilemma describes the difficulty of designing a blockchain that meets all three design goals: scalability, decentralization, and security. Following in the footsteps of Ethereum, other smart contract platforms have been launched that use different designs to find the right balance between security, decentralization, and scalability. Many of these networks, in an effort to attract the attention of Ethereum users and developers, have deployed capital and some form of Ethereum interoperability on their networks. This approach allowed it to accelerate and grow faster than Ethereum.

Layer 1 blockchains, in particular smart contract networks, have a ton of variables that can lead to growth. Here are the 5 most important quantitative indicators can we pay attention to:

- Decentralization

- Safety

- Developers

- Usage

- Profitability

In this report, I will analyze these issues in order in relation to the first-level blockchain networks.

1. DECENTRALIZATION

The main component of web3 is decentralization. It goes hand in hand with security, but it is also consistent with the whole ethic of the phenomenon of feeling sensation.

L1 should be fairly decentralized. No single entity or organization should have control over the network. Anyone should be able to participate in a procedure (mining/staking) or running a ledger (managing a node). The network should not be closed to a select group of people.

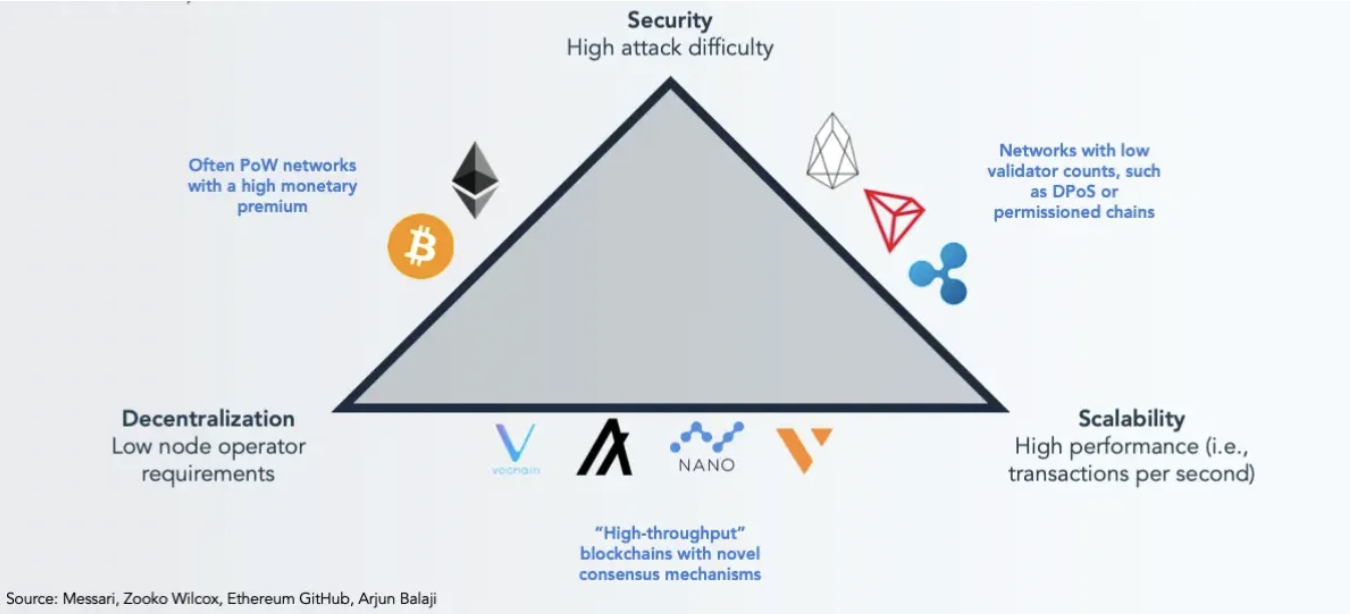

This can be quantified using the number of nodes and/or network validators. Here is a summary of the main Proof of Stake protocols.

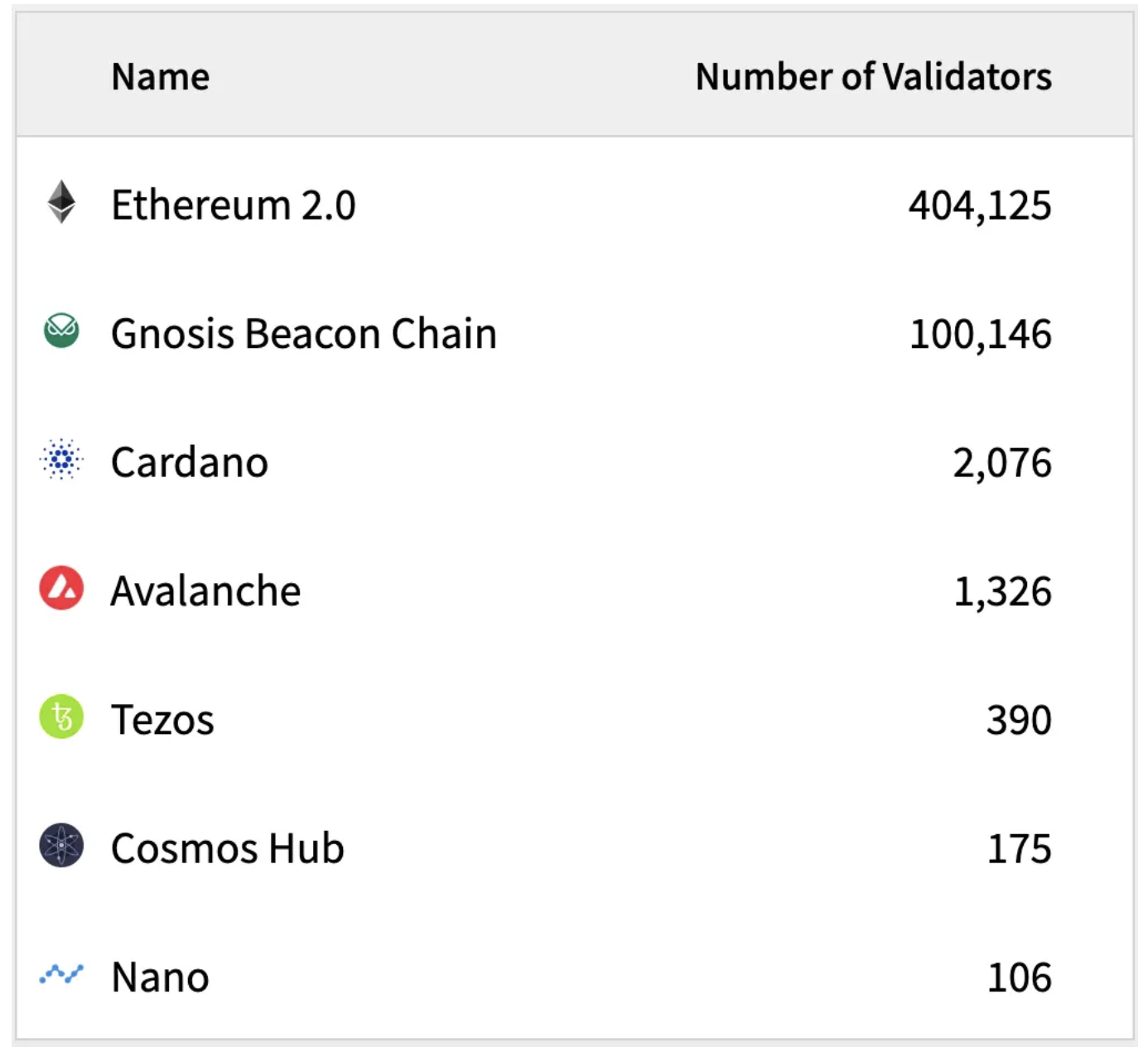

Moreover, we can observe the initial centralisation of main blockchains in the initial token supply allocations

2. SAFETY

Safety should be the top priority when evaluating any layer 1. At its core, the blockchain is a level for calculations. If the calculated level is unsafe, it is worth nothing. You need to be sure that when you make a transaction on the network, your transaction is final. There are various ways to measure security depending on the underlying consensus mechanism, but the end goal is simple — the blockchain network needs exceptional settlement guarantees. A settlement guarantee is a guarantee held by a transaction that states that the network will not reverse the transaction — it is final .There should be no chance of convertibility by dishonest participants. The key variable for evaluating settlement guarantees is the value of the ledger.

Firstly, we should understand is a network capture cost. It can be measured by determining how much money is paid to validators for submitting valid, honest blocks.

Secondly, we can calculate the total network commission income. It is the amount of money that validators are paid to ensure that all transactions are final. A network that pays validators a higher fee income is more secure and can offer higher settlement guarantees. Miners and validators have a strong incentive to submit, validate, and maintain legitimate blocks.

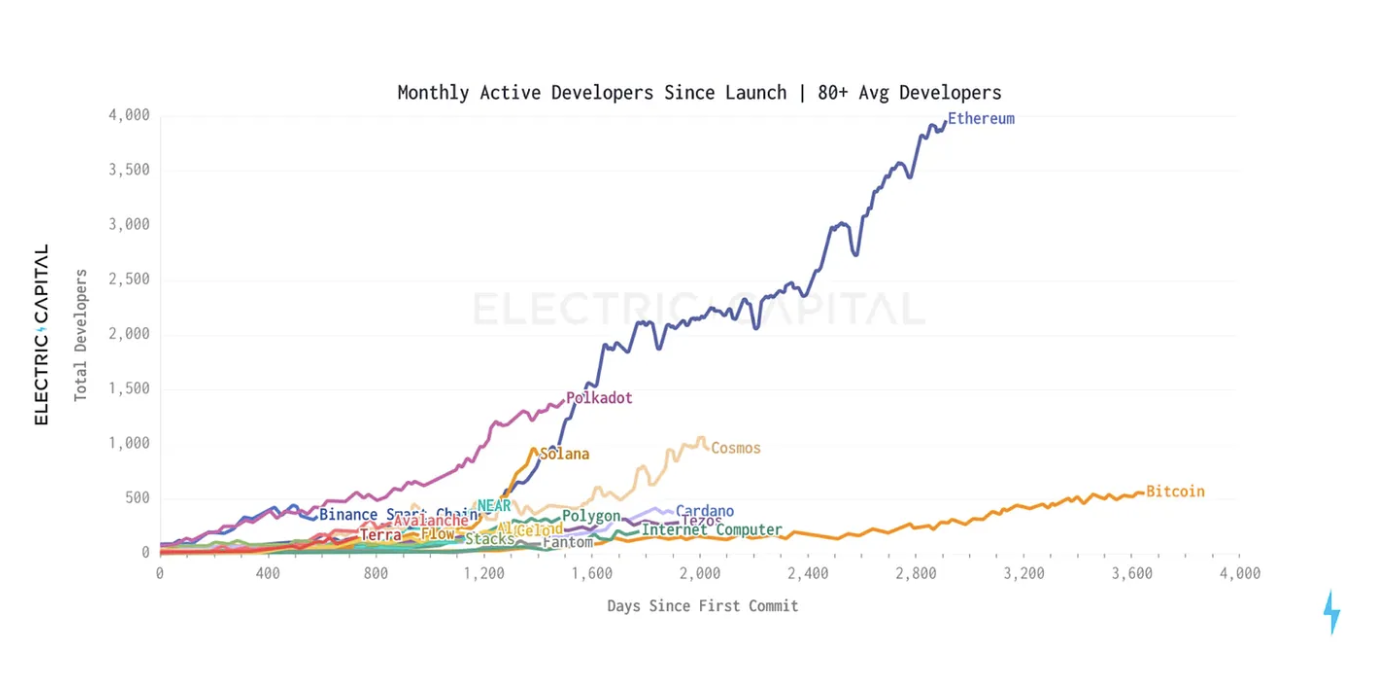

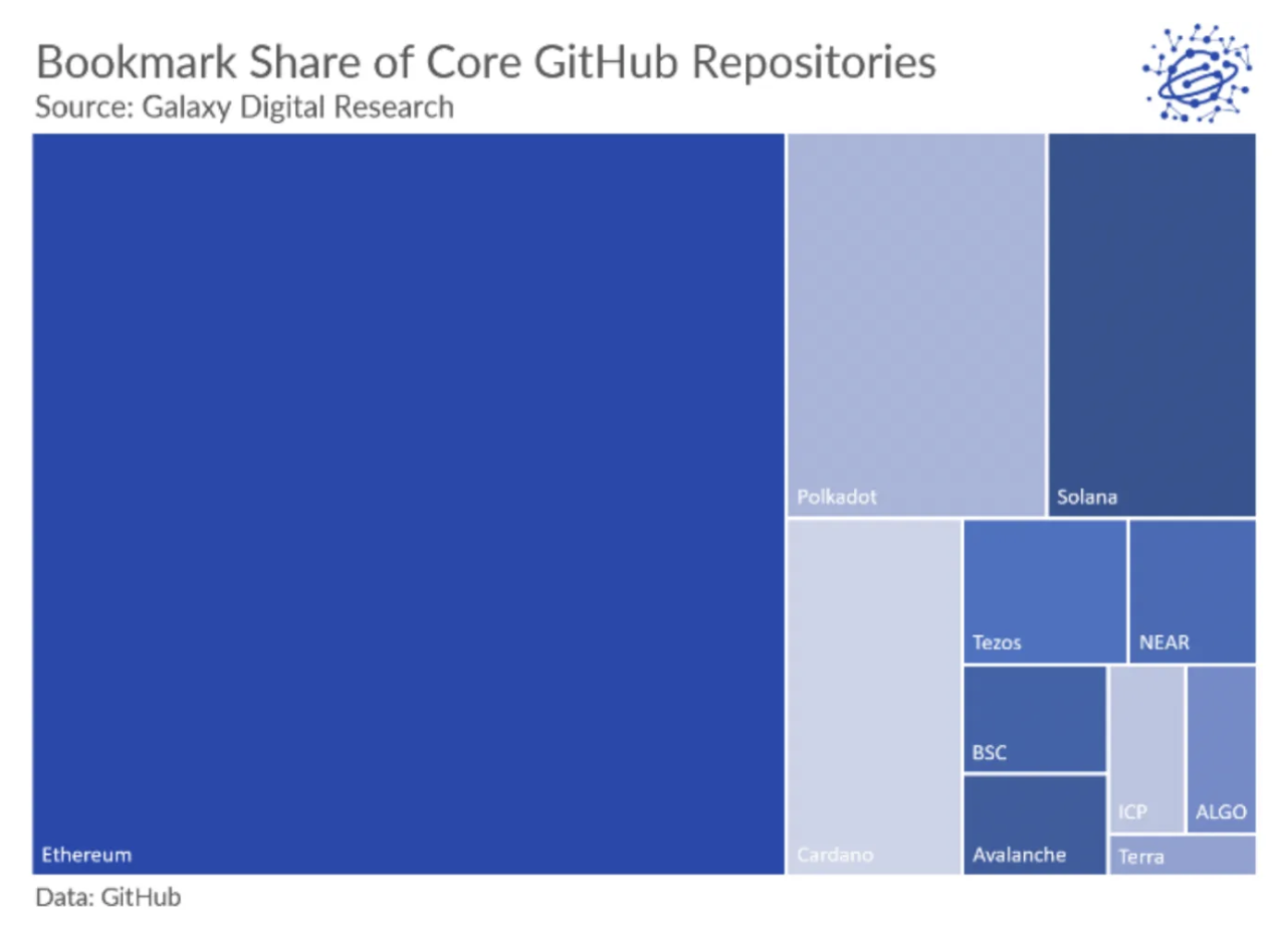

3. DEVELOPERS

There are no apps without developers and no users without apps. Thus, a robust ecosystem of developers is essential for the success of the first tier.

Currently, Ethereum dominates the developer ecosystem. But even newer alternative smart contract platforms are well ahead of Bitcoin in terms of developer activity. This makes sense given the landscape that smart contracts open up for developers — they can build almost anything on them. It is much more difficult to create something cool on Bitcoin. However, for those interested in scaling up, here is a more detailed overview of non-Ethereum smart contract ecosystems.

4. USAGE

Blockchain deals with the sale of blocks. They provide non-stop, decentralized value transfer services over the Internet. Therefore, blockchain demand is perhaps the most fundamental way to understand whether a particular L1 is valuable or not. This is a clear indicator of whether there is demand for value transfer on the network. This can be measured in several ways, ranging from network usage to fees paid to validators/miners. Each of these indicators has its pros and cons, but when considered together, they can give a clearer picture of whether there is real demand for the network.

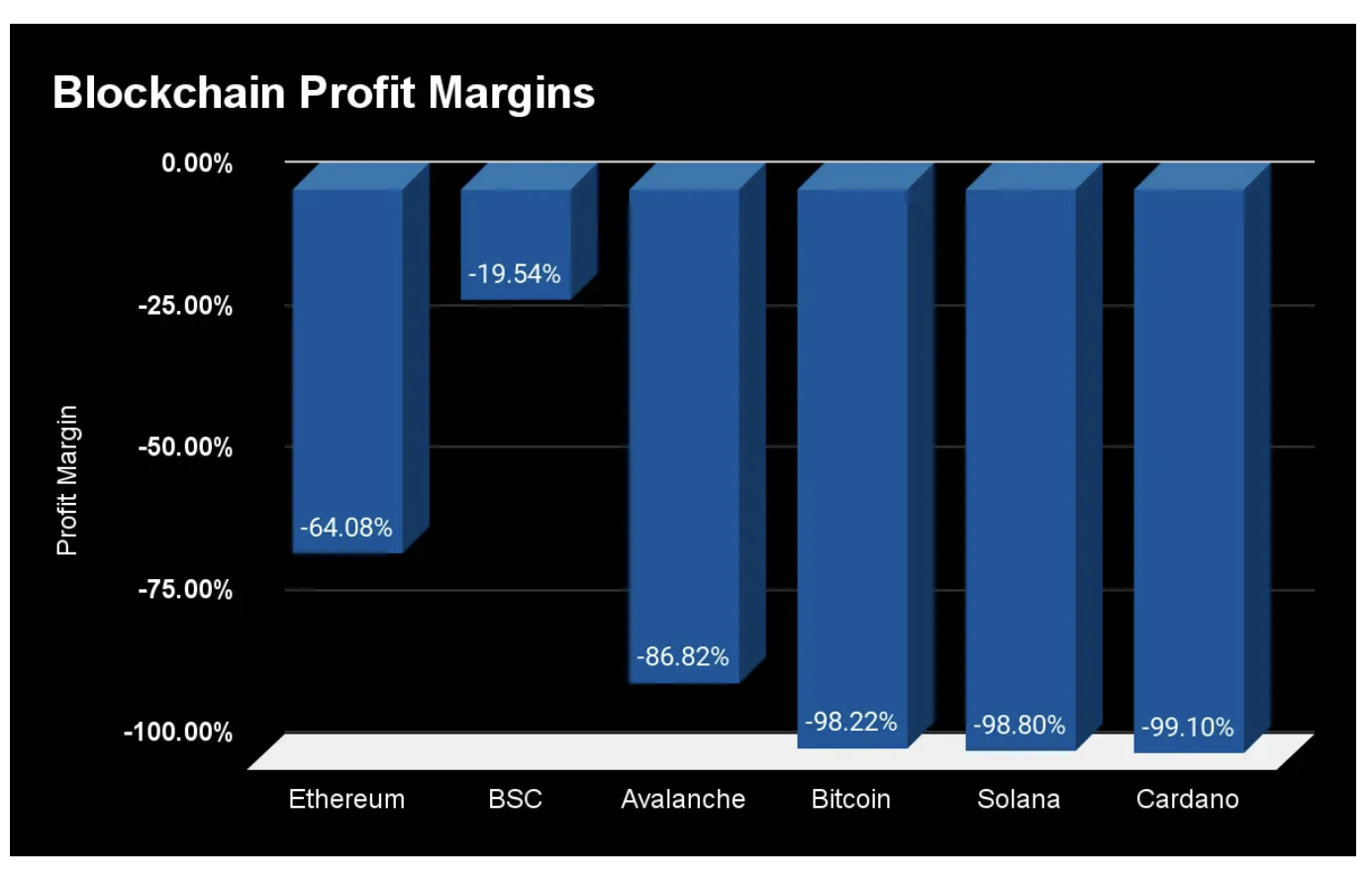

5. PROFITABILITY

If there is a demand for blockchain, there is only one element left to consider. Profit is Total Revenue minus Total Expenses. Some people think this formula doesn’t apply to blockchains. “Blockchains aren’t businesses — they don’t have profit margins”. The profit formula applies to blockchains just as it applies to households, Fortune 500 companies, non-profits, and nation-states. To be sustainable over the long run a network has to sell more than it consumes. Blockchain sell blocks. That’s the revenue. The biggest expense is security, both issuance and transaction fees. In short, you have to find out if the blockchain is issuing more security money than it is generating transaction revenue. The funny thing is that no blockchain is profitable today — not even close.

The ecosystem is young. There are many more developments to come. There are still many people who need to be attracted to this technology. But only one blockchain currently has a clear path to profitability. This blockchain will be Ethereum after the merger.

CONCLUSION

Estimating any L1 is difficult, especially for smart contract platforms. These are new, open platforms for the next generation of Internet applications. As with web2, there will be trillion-dollar companies built on this infrastructure. Major questions will be: how much will this infrastructure cost? And who will be at the top? Use these questions to build your assessment system.

Sources:

- https://medium.com/@nic__carter/its-the-settlement-assurances-stupid-5dcd1c3f4e41

2. https://newsletter.banklesshq.com/p/the-first-profitable-blockchain

3. https://newsletter.banklesshq.com/p/a-framework-for-evaluating-layer?utm_source=substack&utm_medium=email&triedSigningIn=true

4. https://docsend.com/view/tdgbf4sfmyd7sr3m

5.https://theblockchaintest.com/uploads/resources/The%20Block%20Research%20-%20Layer%201%20Platforms%20a%20Framework%20for%20Comparison%20-%202021%20Nov.pdf