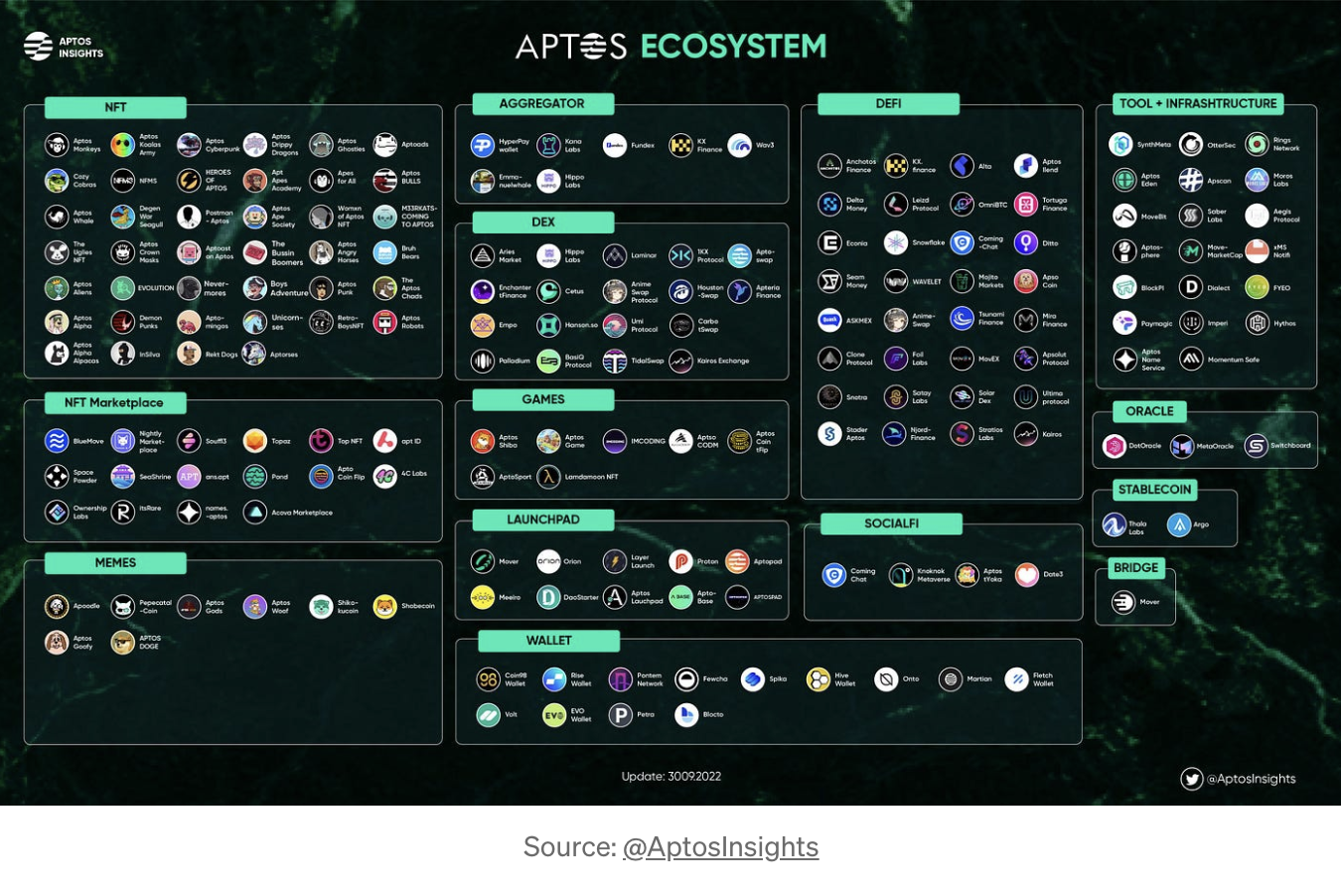

A few days ago, a blockchain called Aptos launched its mainnet. More than 180 projects are building on Aptos across various sectors, starting from DeFi & Infrastructure and ending with Memecoins & Games. Today’s article will go through this novel blockchain to discover its ecosystem closer.

Key takeaways:

- Aptos technology is built on the Move programming language, which was designed for the Diem blockchain.

- Byzantine Fault Tolerant (BFT) consensus allows running processes on the network parallel to each other while increasing the transaction speed.

- The project was under development for 4 years until its mainnet was launched in October 2022.

- Aptos is backed by top-tier venture funds, that gathered a whopping $350M in total funding.

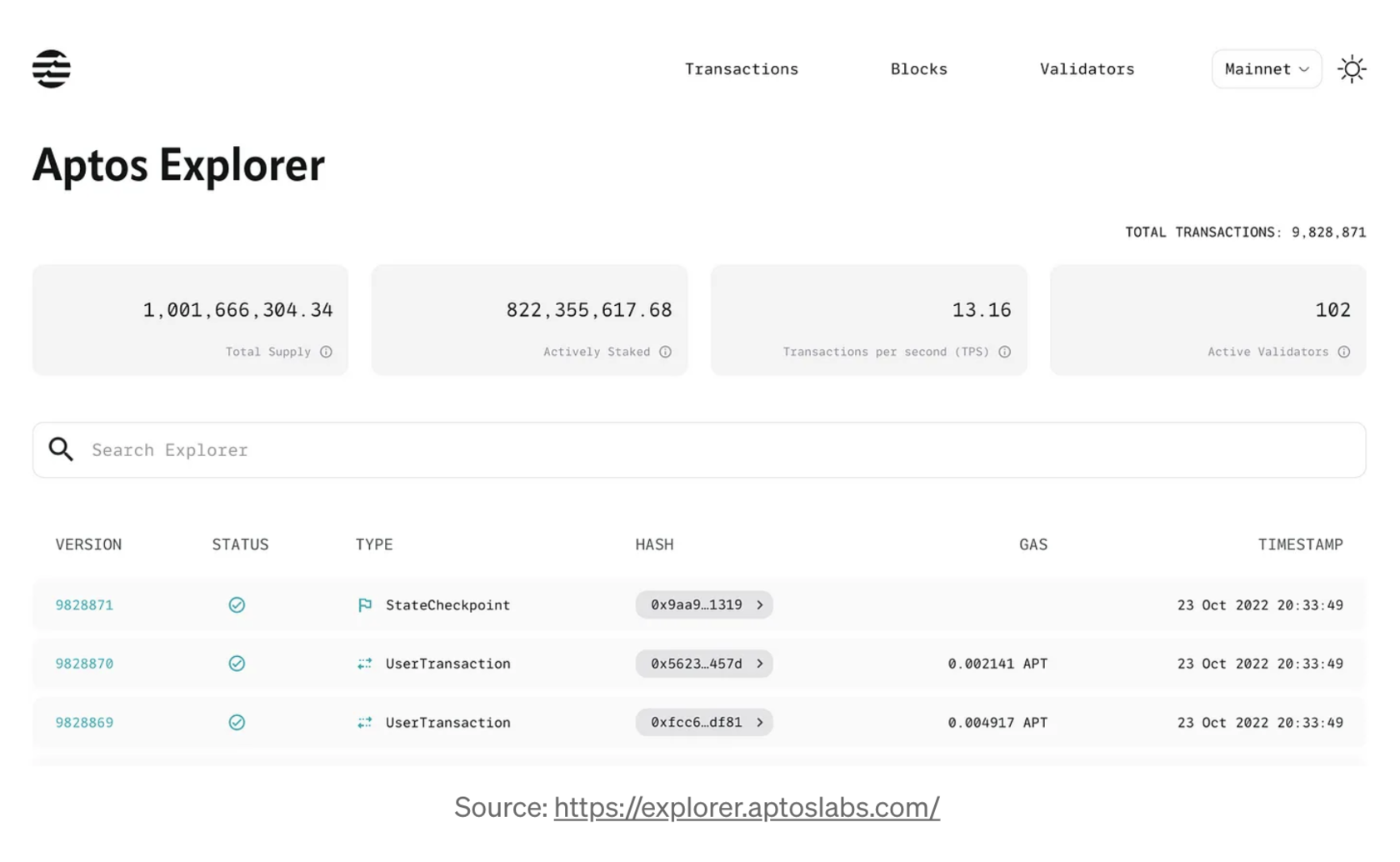

- The current transactions per second (TPS) metric is around 20 at the time of writing, with 102 active validators supporting the network in comparison to Solana, which has over 2000 validators.

Agenda:

- Project Overview

- Tokenomics

- Backers and Partners

- Aptos Ecosystem

- Summary

1. Project Overview

Aptos is a layer-1 blockchain, built by Aptos Labs, an experienced team, that was working on the Diem blockchain project, developed by Meta. Aptos is targeting big layer-1 blockchains like Ethereum and Solana as its competitors, promising better solutions with higher transaction speed and proven reliability. $APT token was launched on the mainnet and listed on major exchanges. The current circulating supply consists of tokens allocated to the Aptos community. A more detailed overview can be found in the tokenomics section below.

2. Tokenomics

$APT token economy presented by The Aptos Foundation looks as follows:

- The total token supply is 1,000,000,000 $APT, 51% of it is reserved for the community, 19% for core contributors, 16.5% for Aptos Foundation, and 13.5% for investors.

- All investors and current core contributors are subject to a four-year vesting schedule, excluding staking rewards. There will be a 12 months lock-up period for these token categories.

- Current staking rewards are capped at a 7% level and are not subject to restrictions on distribution. The maximum reward rate will decline by 1.5% annually until a lower bound of 3.25% annually is met.

- With 820,000,000 $APT actively staked and assuming a 7% annual reward rate. Monthly token inflow into circulation from staking rewards stands at around 5,000,000 $APT or ~0.5% of the total supply.

- The circulating token supply at the moment of writing is 130,000,000 $APT, which represents 13% of the total token supply.

3. Backers and Partners

On 25 July 2022 Aptos Labs raised $150M in a Series A round led by FTX Ventures. Participants in the round were Jump Crypto, Andreessen Horowitz, Multicoin Capital, Circle Ventures, and other big names. Investors from previous rounds are Tiger Global, Three Arrows Capital, and Coinbase Ventures.

After closing the round, the total amount of raised funds is $350M and is planned to be used on ecosystem development.

Considering the usage of cloud services for data storing provided by Google Cloud, a partnership between Aptos Labs and Google can be highlighted.

4. Aptos Ecosystem

Aptos ecosystem is young but growing and expanding at a high pace. There are already functioning DEXes, marketplaces, and DeFi instruments that are used by thousands of users. Below, the state of every ecosystem segment will be reviewed.

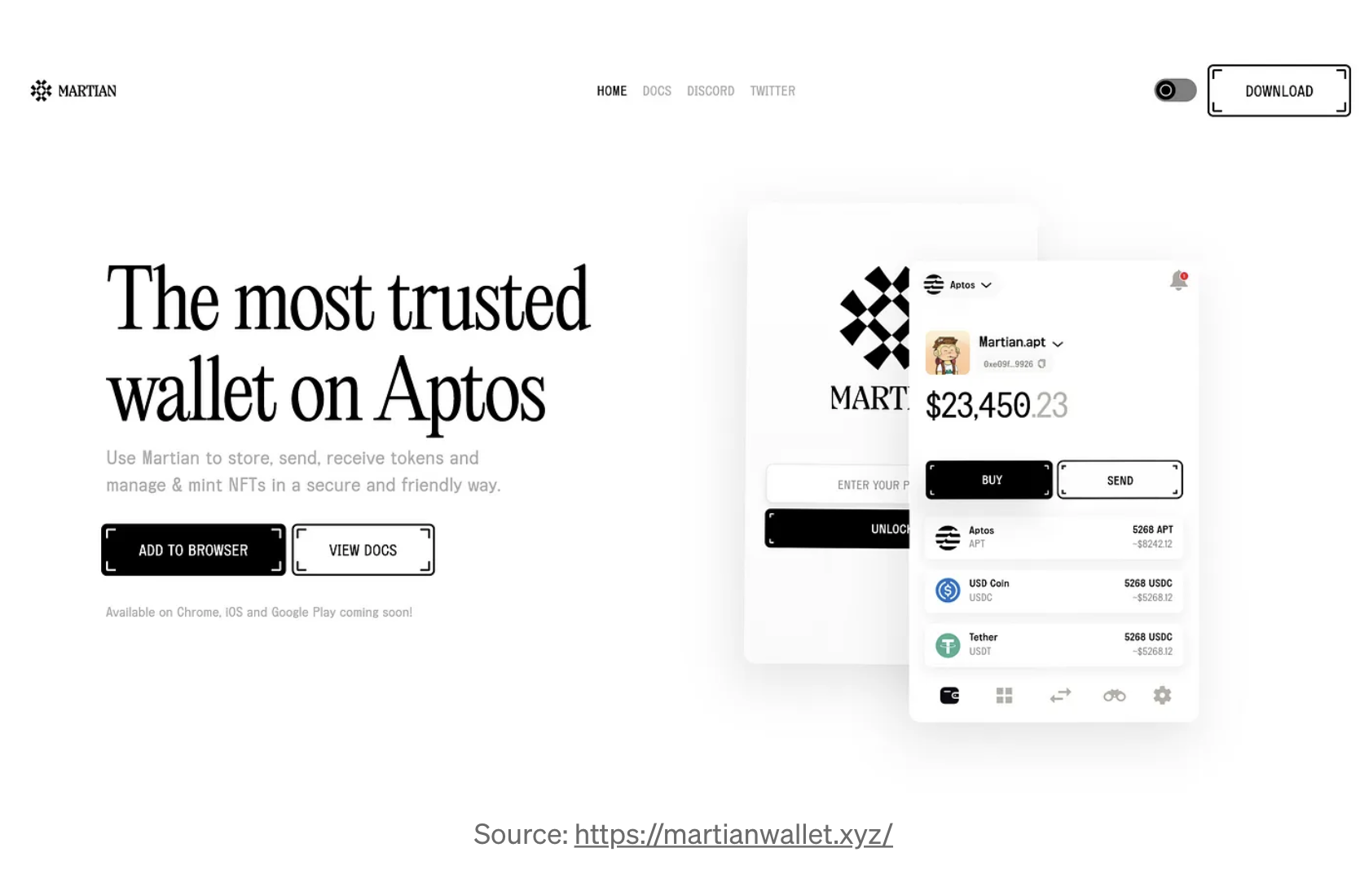

Aptos Wallets

- Martian Wallet is the most used wallet on Aptos, with more than 400,000 users. Currently, it is available as a browser extension, however, IOS and Android versions are planned to be launched soon.

- One more wallet built on Aptos is Petra. It was developed by the Aptos Labs team and has more than 200,000 downloads. At the moment it is also available as a browser extension only.

- Within a few days, there will be a launch of the Fletch Aptos wallet on the Aptos mainnet. The main differentiator is that this wallet is created for IOS/Android users.

Aptos DeFi

This segment consists of decentralized exchanges that are built on Aptos and are used to swap tokens, lending & borrowing protocols, and trading aggregators.

- Currently, the biggest one of them is Pontem which raised $4.5M from investors like Delphi, Alameda, Aptos Labs, and Animoca Brands. At the time of writing, the total value locked (TVL) of funds on the platform is $9M.

- There are lending and borrowing protocols that are still at the testing stage, but few of them are planning to launch soon. Vial, an algorithmic liquidity protocol, Njord Finance, that is supported by Aptos Labs, and decentralized lending/borrowing protocol Aptoslend. All of them are in the development stage but are planned to be launched soon.

- With dozens of already-built DEX protocols, Hippo operates as a liquidity aggregator across them. Since the Aptos mainnet launch, the Hippo aggregator generated more than $500,000 in total trading volume.

- Tortuga Finance is a liquid staking protocol live on Aptos mainnet, it is backed by FTX and Jump Crypto. The platform has around $3M TVL at the moment of writing.

Aptos Launchpads

Many different projects are going to launch their own tokens, for that purpose launchpads built on Aptos will be used. Most of them are still in the development stage, however, some are near ready to launch on the mainnet:

- Projects like AptosLaunch, Meeiro, and Protonsale are expected to be the first launchpads operating on Aptos mainnet.

- Also, the integration of the Aptos network into the existing incubator platforms was made by DaoStarter, which started supporting projects that are built on Aptos.

Aptos Infrastructure

Infrastructure projects of the Aptos ecosystem are:

- Oracles that work with Aptos: DoTOracle, Pyth Network, and SwitchBoard. Major oracles like Chainlink haven’t announced Aptos support at the moment of writing.

- There is one known project that is building a bridge on Aptos, it is Mover, which is currently at the alpha testing stage and is preparing to launch on the Aptos mainnet soon.

- Aptos Explorer is used as an explorer of the Aptos network activity.

- Dialect is building a wallet-to-wallet messaging tool for Solana and Aptos users. The solution is backed by $4.1M raised funds from Multicoin Capital and Jump Crypto.

Aptos NFT Marketplaces

- One of the biggest Aptos NFT marketplaces is Topaz. It was also one of the first marketplaces that started operating on Aptos mainnet almost immediately after its launch. Topaz marketplace is responsible for more than 100,000 $APT trading volume and is a trading place for the biggest Aptos NFTs.

- BlueMove is another Aptos NFT marketplace that is also used as a launchpad for NFT collections. The launch of the platform on Aptos mainnet was made a little bit later in the BlueMove case, and after 2 days of operating the total NFTs trading volume on the platform stands at more than 15,000 $APT.

- One more marketplace, that can be added to this list is Souffl3. This NFT platform also leverages additional functionality like launchpad launching of various NFT collections and has more than 50,000 $APT total trading volume.

Aptos NFT

NFT collections that are launching on the Aptos blockchain:

- Aptomingos — the collection of 1212 flamingos launched by B.FLY LABS and was minted for free, now it has more than 60,000 $APT trading volume and a floor price of 160 $APT.

- Aptos Names — Aptos Name Services (ANS) is used as a human-readable .apt name for the Aptos wallet addresses.

- Aptos Wizards — the collection of 5,000 pieces of art, launched on the BlueMove marketplace launchpad and sold out in seconds.

- Bored Aptos — 10,000 Bored Aptos Yacht Club collection that is not affiliated with Yuga Labs.

- Rekt Dogs — one of the most anticipated Aptos NFT collections with more than 70,000 followers on Twitter.

NFTs launching on Aptos are quite hyped at the moment, so it is important to be aware of various scams around it.

5. Summary

In conclusion, it seems like the Aptos ecosystem is widely expanding into every sector of the crypto industry. It is gaining a lot of attention after the successful launch of the Aptos mainnet and the airdrop conducted for early adopters and members of the Aptos community. Taking into account the early stage of ecosystem development there are many opportunities to profit for investors by actively participating in top ecosystem projects, therefore qualifying for potential future retrodrops.

Sources:

- https://coin98.net/aptos-ecosystem

- https://help.ftx.com/hc/en-us/articles/10138760727956-Aptos-Research-Report#:~:text=07%3A47%20UTC-,Overview,decoupled%20transaction%20dissemination%20and%20consensus.

- https://twitter.com/AptosInsights/status/1575764594085093376

- https://coinmarketcap.com/alexandria/article/what-is-aptos-the-ultimate-guide-to-the-aptos-ecosystem

- https://defillama.com/

- https://aptoslabs.com/