Executive Summary

AngelBlock is an innovative solution in the world of Web3 investing. DeFi protocol, which is aiming at solving the issues of fundraising for digital assets and making the process crypto-native. Focusing on simplicity of use, transparency, compliance, and decentralization, the AngelBlock team is creating a hybrid platform for multiple forms of fundraising, investor activity, and community building.

Mostly all of the platform functionality is based on smart contracts and non-custodial wallets, leading to more transparency, higher safety, and more autonomy.

The project’s detailed analytics with ROI projection can be found in the Deal Sheet, prepared by the 3x Capital Research Department.

1. Introduction

Each Web3 fund has its startup selection process, including detailed due diligence, such as background checking, financial data analysis, and legal side review, before making an investment decision. On top of that, every fund has its mandate and strictly defined conditions of investment target.

Considering token investments, quite often, venture fund exit strategies are designed aggressively, therefore, harming the process of startup development and scaling. With traditional fundraising, a startup is at the whim of large-scale, institutional players that control valuations and term sheets.

Startups are expected to grow exponentially, at a pace not necessarily adjusted to the market they develop in or the capabilities of the team, but to the expectations and milestones, set forth by the VC. Statistical approach of venture investments, which means betting on 10 projects, while expecting 9 of them to fail and 1 to grow aggressively, is also putting pressure on founders and startups not to only succeed with their ideas but to succeed spectacularly covering all expenses and unprofitable deals for VCs.

Many great ventures are failing not because they didn’t have a great product or couldn’t achieve product-market fit, but simply because they were unable to raise funds efficiently before they started turning a profit.

That being said, new ways of attracting funds for Web3 are needed, something that will be transparent, decentralized, and fair to startups, alongside their development.

2. Market Overview

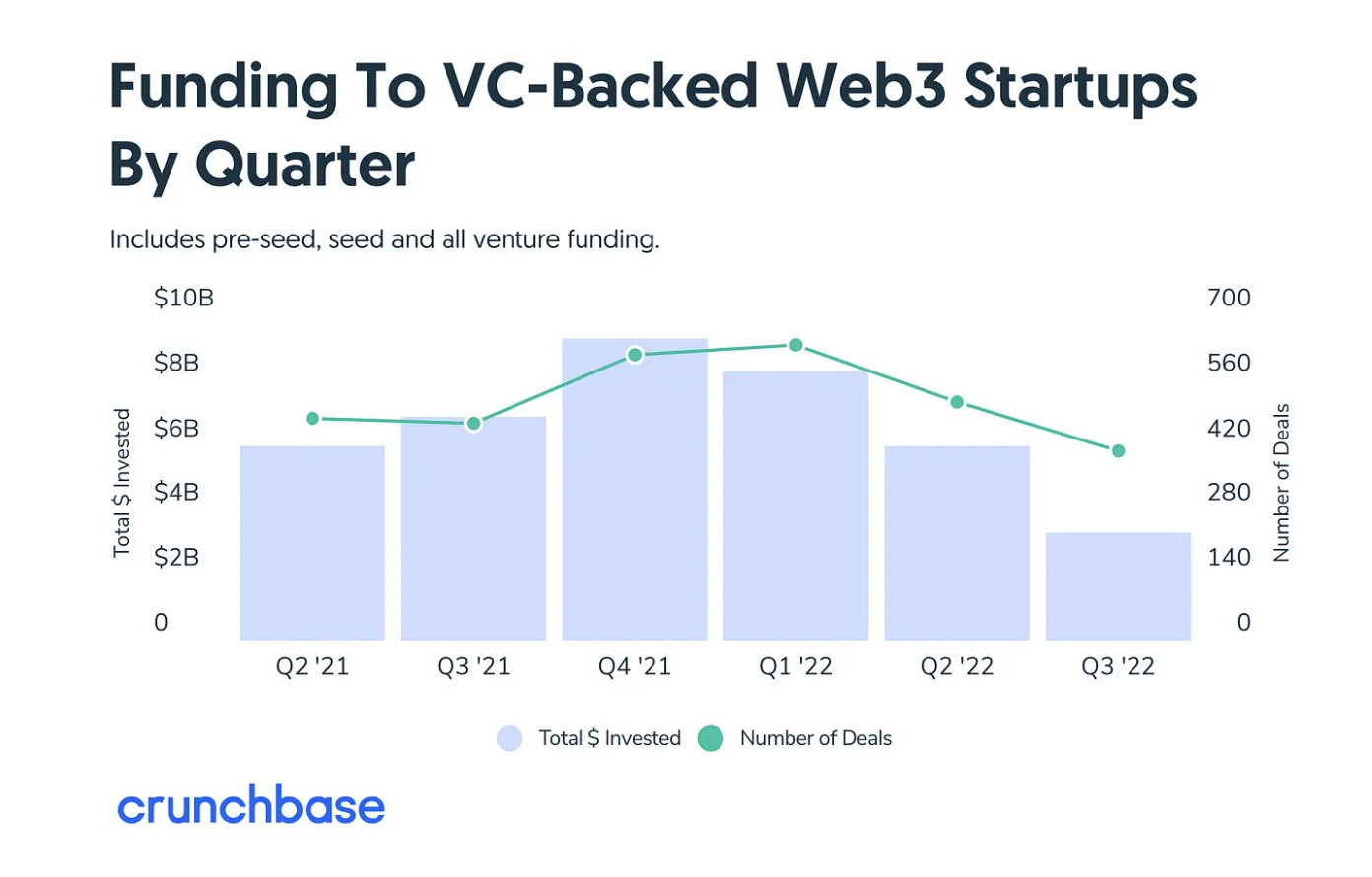

According to the Crunchbase report, investors are tightening their purse strings on everything right now — and that even includes the next iteration of the internet. For the last two years, venture capitalists have been enamored with all things Web3. However, after a record-breaking 2021 which saw more than $30 billion invested in this burgeoning space, investors seem to be taking a pause. Funding to VC-backed Web3 startups, as well as the number of deals, dropped to its lowest since the end of 2020.

Despite the downturn, there are still some positive trends. During September, Web3-focused startups raised $1.6B from VCs, marking the best month since June for Web3 funding. Companies like Aptos Labs, Mysten Labs, continuous settlement protocol Zebec, and London-based blockchain network 5ire, all became unicorns by closing large fundraising rounds in Q3 this year.

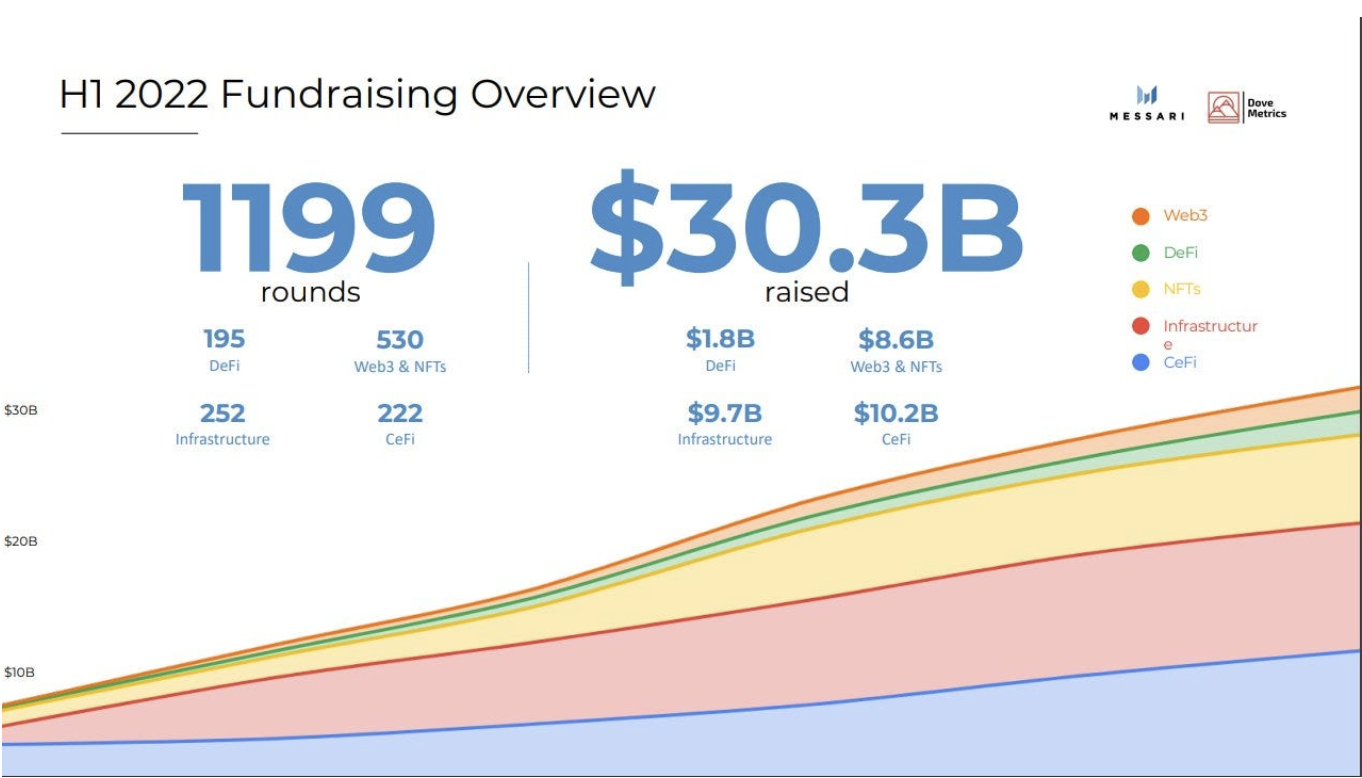

On the other side, Messari's report noted that in the first half of 2022 cryptocurrency sector has raised $30.3 billion in funds, seeing an increase in digital assets interest from hedge funds. Worth adding that Web3 and NFT sector, which raised $8.6 billion in funds during the half-year, saw gaming-related NFTs capture the lion’s share of investment, raising more than four times as much as any other NFT vertical.

On the other side, Messari's report noted that in the first half of 2022 cryptocurrency sector has raised $30.3 billion in funds, seeing an increase in digital assets interest from hedge funds. Worth adding that Web3 and NFT sector, which raised $8.6 billion in funds during the half-year, saw gaming-related NFTs capture the lion’s share of investment, raising more than four times as much as any other NFT vertical.

Even with current market conditions and the meltdown of investors' appetites, VCs are sitting on a record pile of uninvested capital and will be ready to deploy it actively as soon as market recovery will come on track.

3. Solution

AngelBlock offers a solution to a chaotic investment process and as a result high portion of unsuccessful investments. Moreover, this solution will bring a platform for startups to stage their fundraising campings there. The basement of this system will be a community of investors, developers, and other interested parties within one platform.

AngelBlock platform solution is built for both sides of investing process:

Platform for Investors

- The goal is to build a platform for people who follow the innovation brought by blockchain technology, so they will be able to invest in industry ideas they believe in.

- It’s crucial to differentiate AngelBlock from crowdfunding platforms, as not every investor will be accredited to invest in every startup. There will be a balance between providing significant, qualified investors and the dispersion of capital between smaller contributors.

- Potential startups queued for fundraising will undergo AngelBlock due diligence, which will cut down time on analytics and research done by investors.

Platform for Startups

- Implementation of milestone-based checkpoints will allow continuous delivery of roadmap objectives from startups, while funding will become available through achieving milestones, therefore protecting investors from bad actors or startups that stall their objectives through lack of planning or expertise.

- To mitigate the downsides of acquiring small individual investors, AngelBlock will be bringing investors who understand startup business and are keen on supporting new ventures for long-term success.

- Investors’ experience will be analyzed by AngelBlock, considering not only traditional finance expertise but more relation to the blockchain sector. This will bring potential support, feedback, and mentoring, in addition to invested money.

- One of the biggest values for startups will be reducing time spent on raising funds, instead, this time can be used on building and growing startup solutions.

- After the close of the first rounds, startups still will be receiving support from the AngelBlock team and respective investors.

Platform demo video with detailed functionality description can be viewed below.

4. Competitors

There are no direct competitors to AngelBlock’s novel solution, while the functionality of various launchpads can be considered indirect competition.

Some of the most noticeable AngelBlock’s competitive advantages include an option of equity investment, investors' smart contract protection, community governance, and startup support with social networking and community-building tools.

5. Team

There are 13 members in the AngelBlock core team.

- Alex, who is the founder and CEO of the project is focused on crypto-based startups for the last 6 years. A former crypto-fiat exchange executive and a blockchain consultant for one of the largest FMCG companies in Europe. Most recently Alex was working with Gamerhash and Aleph Zero as an advisor.

- Co-founder and CLO, Dawid holds a degree in Law from a Polish university. Before joining AngelBlock, he was holding the position of Head of Legal at an International Cryptocurrency exchange for two years.

- Third co-founder and CTO, Marcin ran the blockchain department in one of the largest software houses on the European market. Lately, Marcin was working on DeFi option trading AMMs. Also, he was awarded the #itheroes title for working on improving the speed of pharmaceutical drug delivery.

AngelBlock advisory board consists of 10 advisors from various blockchain funds and organizations. A full description of the team members can be found in the whitepaper.

6. Tokenomics

$THOL will be an integral part of the platform, allowing users to participate in AngelBlock’s governance, influencing development, gaining access to additional features, and more.

One of AngelBlock’s revenue streams will be built on a % success fee after the completion of a successful raise. 50% of this fee will be considered as company income, 25% will be used to reward the Validators of the Startups, and the rest 25% will be used to buy $THOL tokens from the market.

At the time of the Token Generation Event (TGE), the $THOL token will have the following functionality:

- Token Staking — earning deflationary APY in exchange for nominating Validators of Startups

- Gaining access to the AngelBlock platform.

- Additional privileges, based on the number of tokens held in the wallet.

Some additional utilities will be implemented after TGE:

- Additional forms of raising capital via the token.

- Priority deals and exclusive listings.

- $xTHOL based governance model.

- Community-oriented rewards.

- $THOL collateralized borrowing for investment.

- Liquidity sourcing — Creating new liquidity pools with $THOL in pairs.

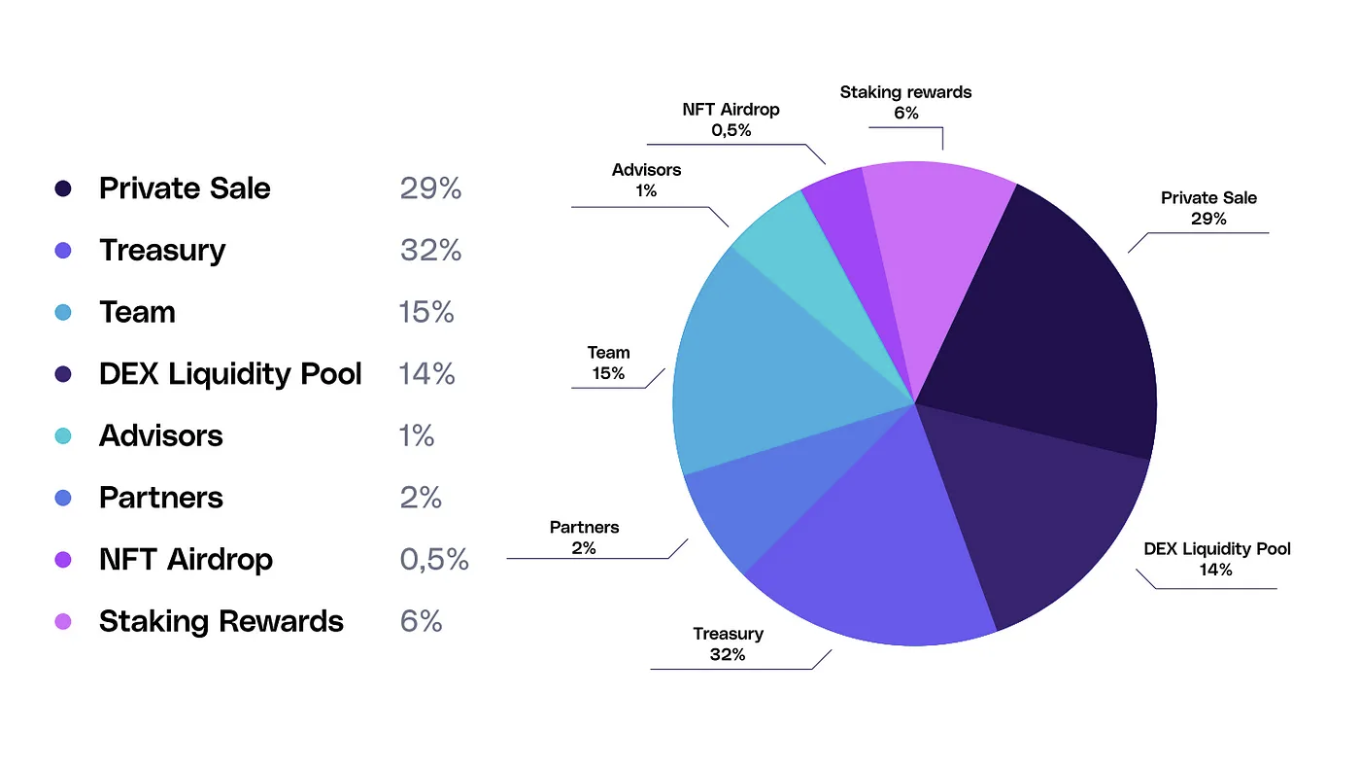

The total supply of $THOL will be capped at 480M tokens and distributed according to the allocation model.

- Allocated tokens will be vested following the distribution schedule:

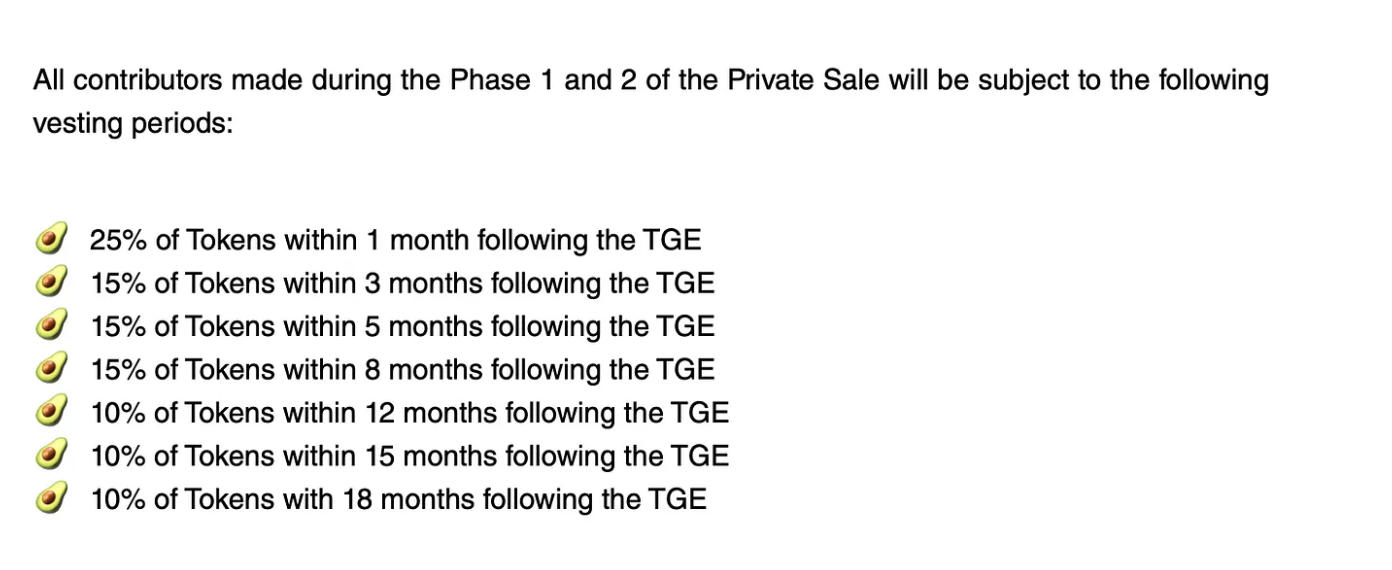

Private Sale Tokens

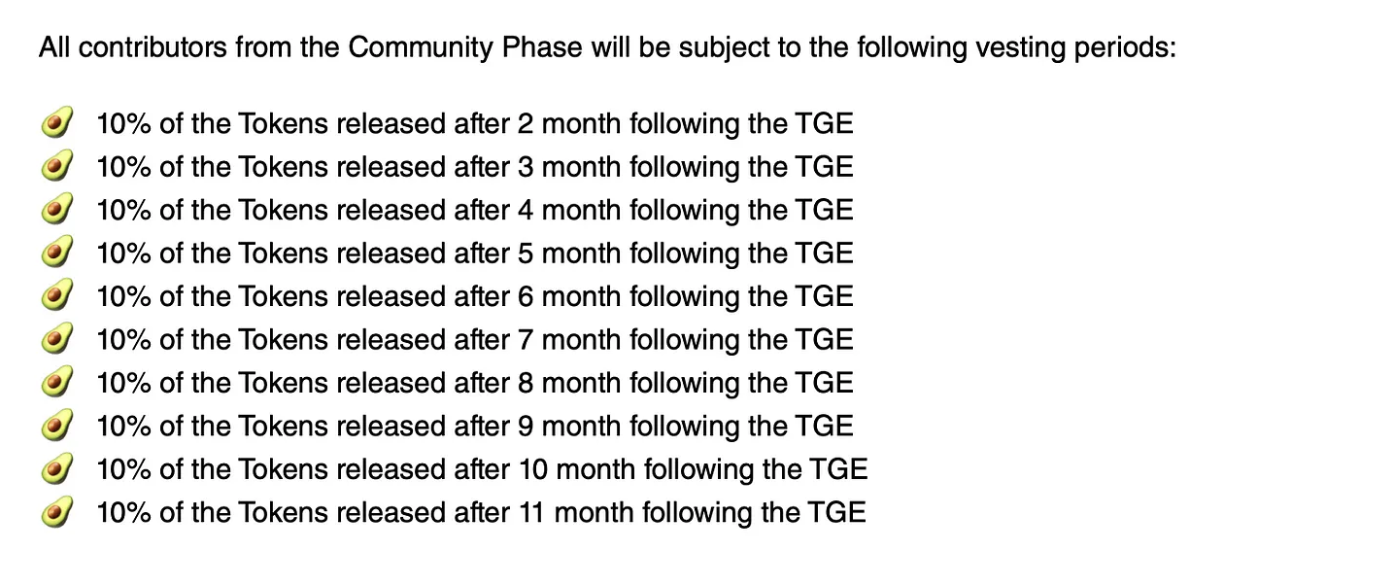

Community Phase Tokens

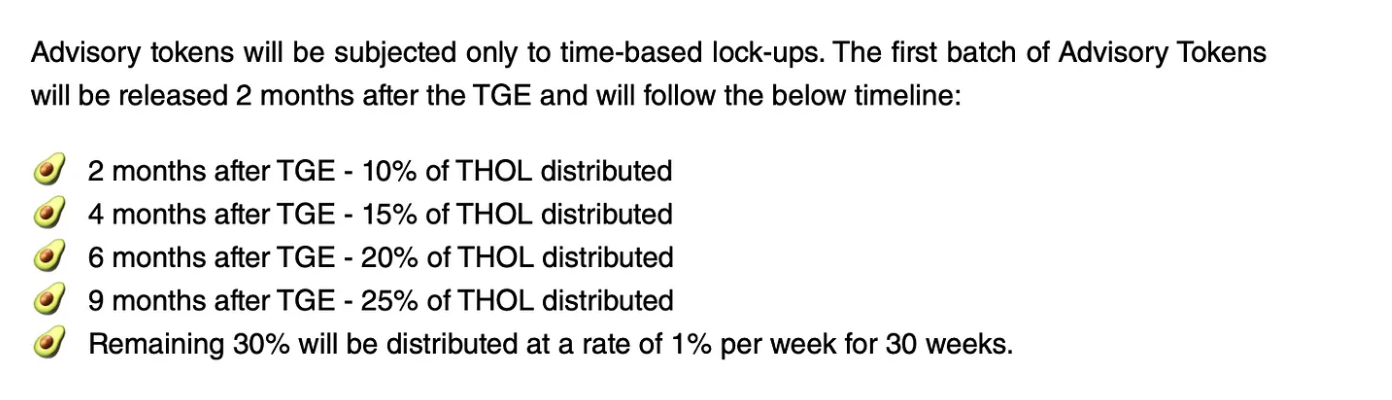

Advisory Tokens

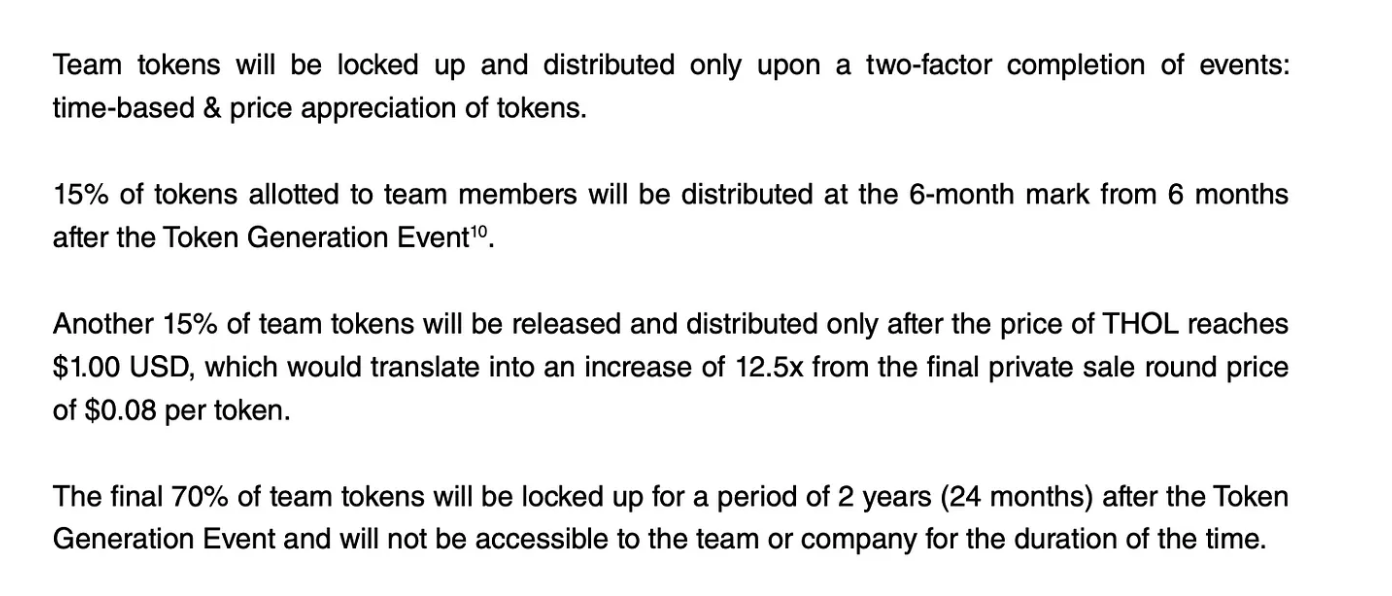

Team Tokens

7. Communities

AngelBlock’s Twitter is followed by 7K users and has an SMP score of 6. Some noticeable followers are the CEO of Sino Global Capital, founder of Investor Place Bitcoin Foundation, and creator of the DataDash YouTube channel. Discord channel has 1.3K members with an 11% engagement rate. There are 1.6K members in Telegram channel with 200 average online.

Community growth strategy is partially based on the launch of NFT collections. The first one was created in May 2022, called AngelBlock NFT it generated 86 $ETH in total trading volume since launch while maintaining a higher floor price than the 0.069 $ETH price of mint.

AngelBlock can be considered a community-oriented project, due to its token utilities and the launch of a community phase sale, which has the same participation conditions, as a private round.

8. Investors and Partners

AngelBlock backers are mainly tier 3 funds like Kangaroo Capital and Space Capital. Investments were also made by CSP & MetFi DAOs and angle investors like Teddy Cleps & DreadBongo

9. Roadmap

AngelBlock has an extensive roadmap, with defined milestones for each quarter’s capturing the whole period from 2020 until early 2024. There are almost low to nothing delays in delivering updates, which is quite a noticeable advantage, taking into account current market conditions.

Some of the already met achievements are smart contract audit, the launch of AngelBlock v1 platform with core functionalities, minting the first batch of the NFT collection, and the start of the community sale round.

The most important future milestones to be achieved, consist of:

- Token generation event (TGE).

- $THOL and NFTs staking implementation.

- Conducting a first startup fundraising round on the platform.

- Integration of other L1 blockchains in addition to Ethereum.

- Launch of $xTHOL governance token.

- Launching post-investment incentives for users.

Somewhat end game for AngelBlock will be a transition into a fully decentralized autonomous organization (DAO)

Find out how to participate in the AngelBlock community phase sale in our telegram:

https://t.me/Web3XC