Intro

The decentralized application (dApp) ecosystem has grown exponentially in recent years, with new projects and advancements in blockchain technology driving innovation in various industries. However, in 2022, the dApp ecosystem faced some challenges due to the economic recession and the bear market in the crypto space.

Despite this, the ecosystem continued to evolve and mature, with a growing number of users and transactions on the network. This analytical report aims to provide a comprehensive overview of the state of dApps in 2022 using various metrics such as Total Value Locked, earnings, active users, etc.

The report will also take into account the impact of the recession and bear market on the niche, and provide a comprehensive analysis of the key trends, adoption rates, and the most popular use cases. The report also includes an analysis of the leading blockchain platforms and their respective dApp ecosystems, as well as an examination of the challenges facing the dApp industry.

Overall, this report aims to provide a snapshot of the current state of dApps in 2022, taking into account the economic downturn, and offer insights into the future of this rapidly evolving ecosystem.

Agenda

- Executive Summary

- Metrics

- Key Milestones 2022

- Trends for 2023

Executive Summary

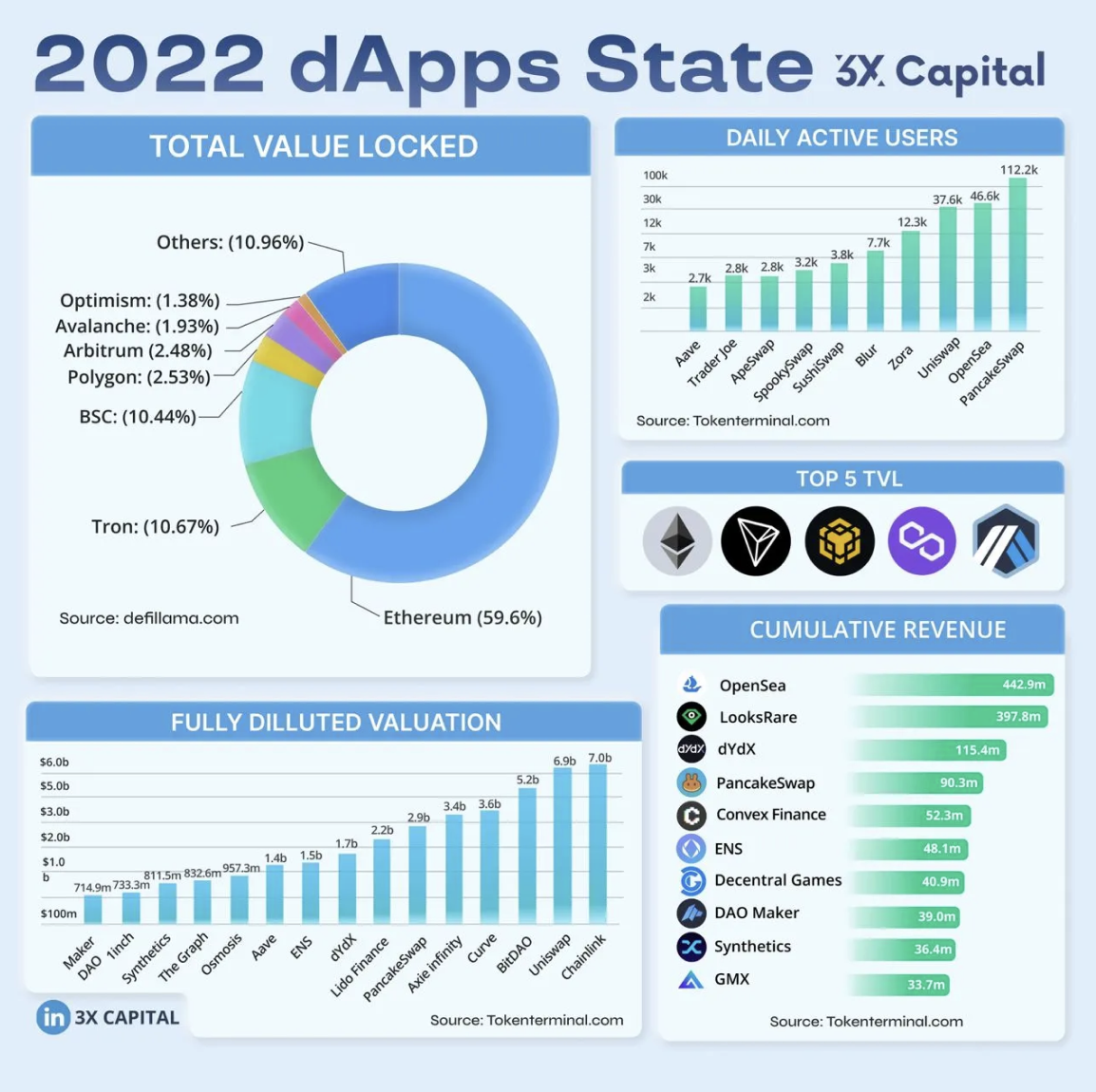

- The top decentralized applications by circulating market cap (CMC) are Uniswap ($5.0B, 76% liquid supply), Chainlink ($3.4B, 51% liquid supply), and Lido ($1.6B, 82% liquid supply).

- In comparison to a 75% market total value locked (TVL) decrease in 2022, top Defi projects lost significantly less value than the market on average.

- The absolute leader by cumulative earnings is OpenSea with $445M

- Users' preferences were tied to NFT marketplaces and Dexes (decentralized exchanges), as the top platforms by DAU (daily active users) are PancakeSwap and Opensea.

- Developers were focused mainly on infrastructure niche

Metrics

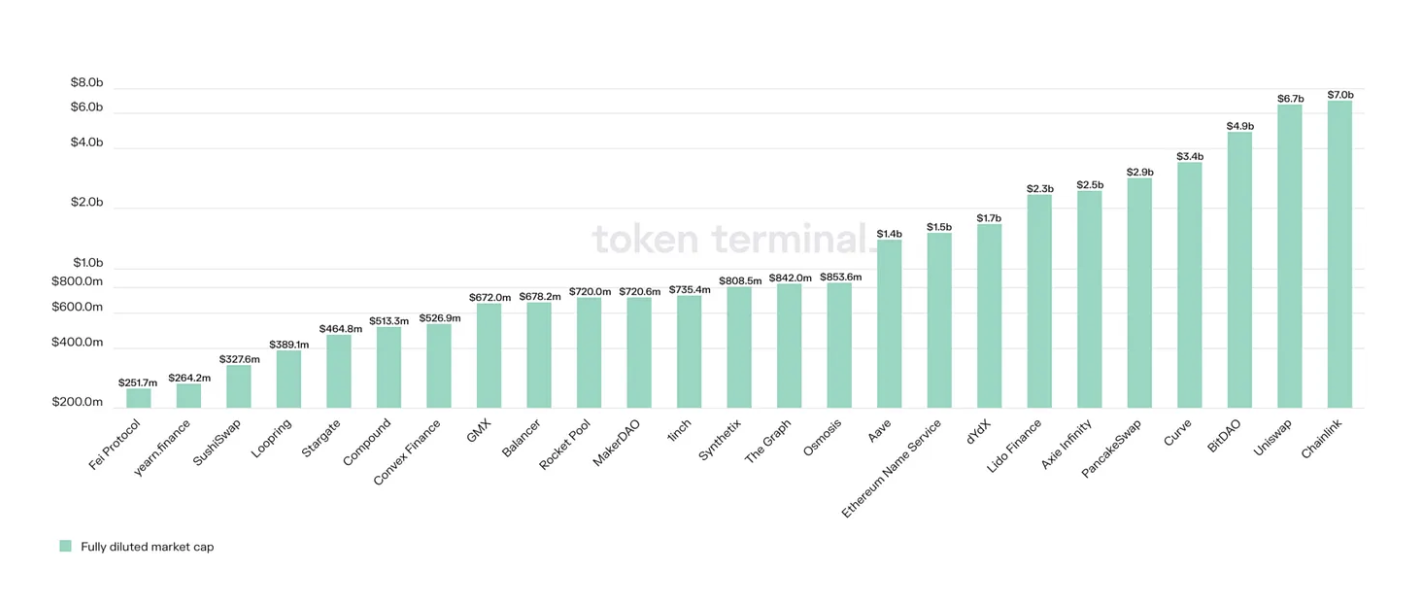

Daily FDV in the past 180 days

Fully diluted valuation in cryptocurrency refers to the estimated value of a cryptocurrency company that includes all existing coins or tokens and all potential new coins or tokens that could be issued in the future.

FDV = (Number of existing coins/tokens + potential new coins/tokens) * Coin/Token price

In terms of the total fully diluted valuation (FDV) of top dApps, we may notice a significant decline from $50B to $30B, however, in 2023 it is expected to recover. The leaders in terms of FDV are:

- BitDao

- Chainlink

- Uniswap

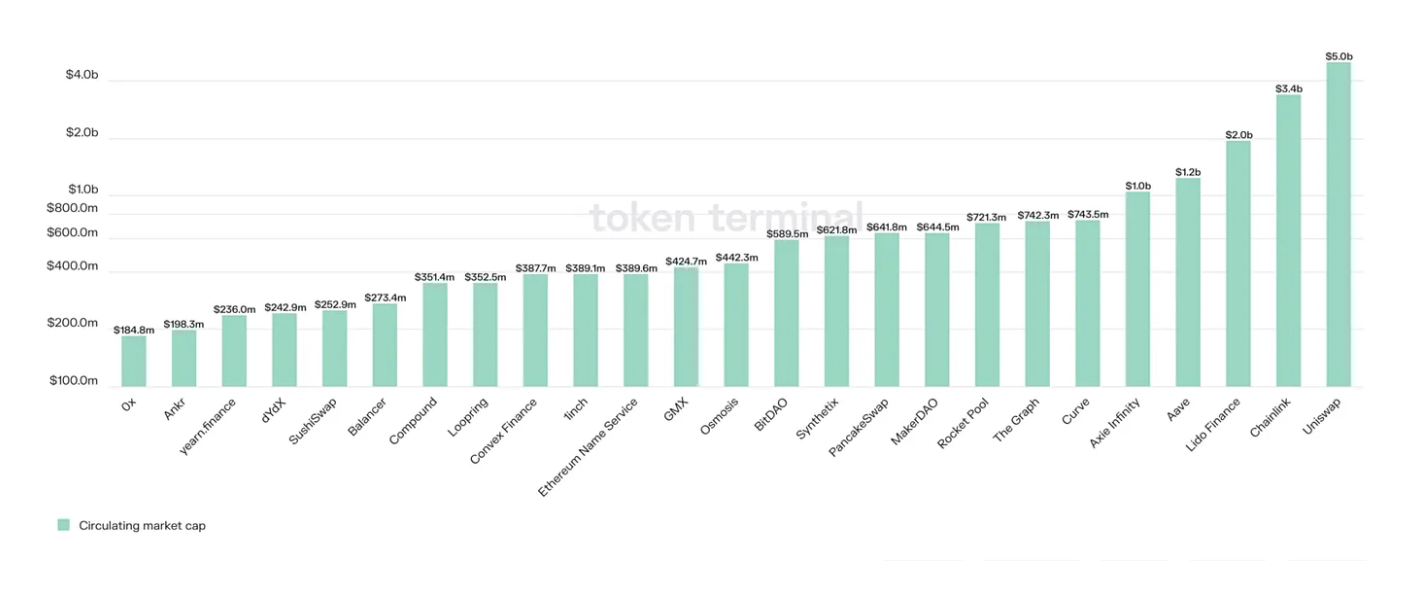

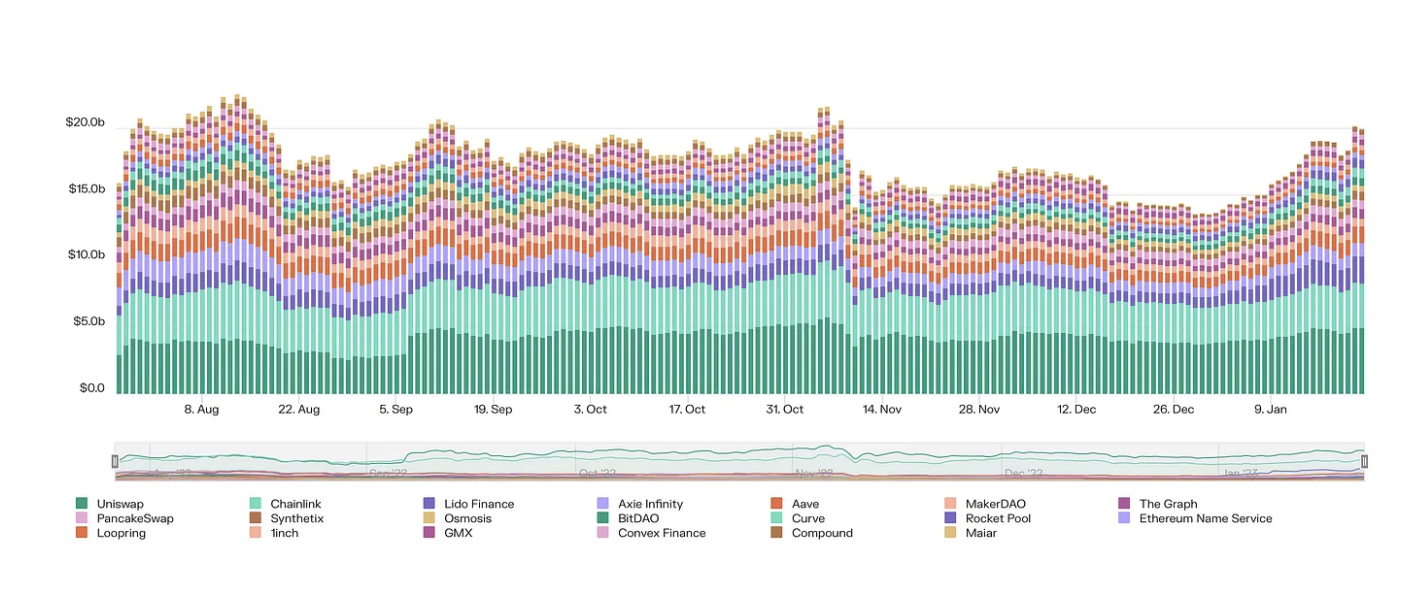

Daily CMC in the past 180 days

Circulating Market Cap (CMC) in cryptocurrency refers to the market value of all the coins or tokens in circulation and readily available for trading.

CMC = Number of circulating coins/tokens * Coin/Token price

The total circulating market cap (CMC) of top dApps fluctuated in the range from $20B to $15, and was mainly allocated in the top 3 projects:

- Lido Finance

- Chainlink

- Uniswap

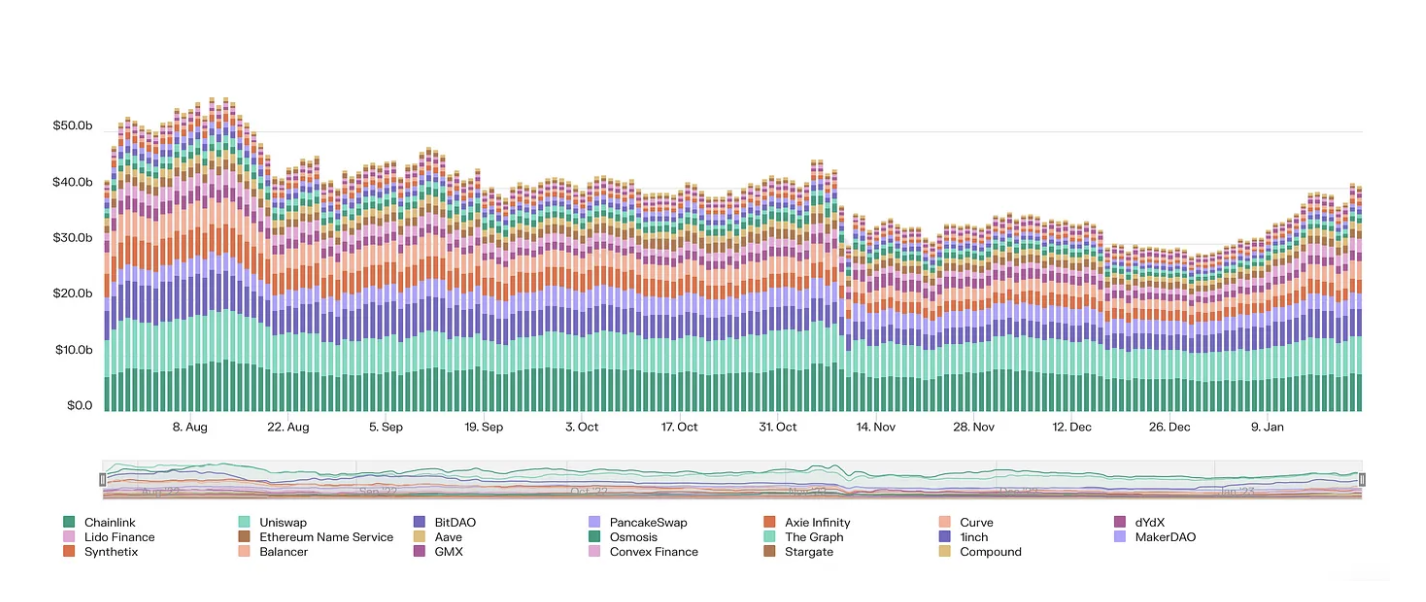

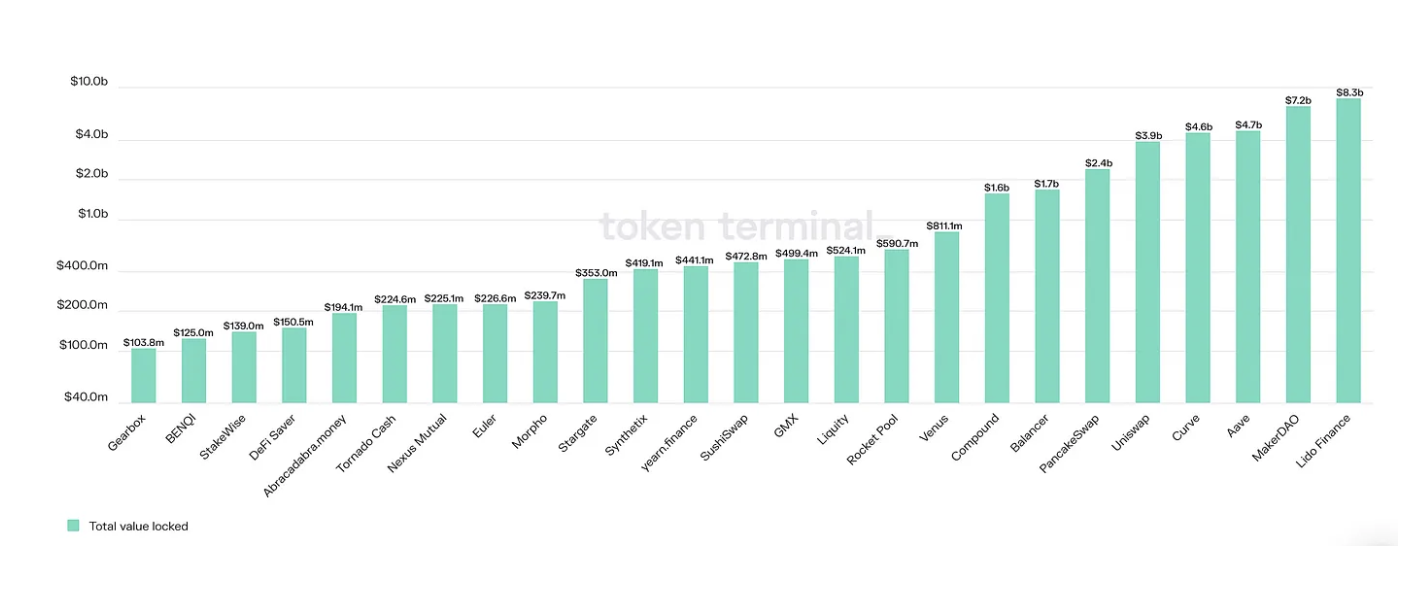

Daily TVL in the past 180 days

Total Value Locked (TVL) in cryptocurrency refers to the total value of all digital assets locked into decentralized finance (DeFi) protocols, such as yield farming, staking, and lending platforms.

Based on the metrics we could highlight Lido as the leader based on the TVL. The project will face major updates which we will cover in the next paragraphs.

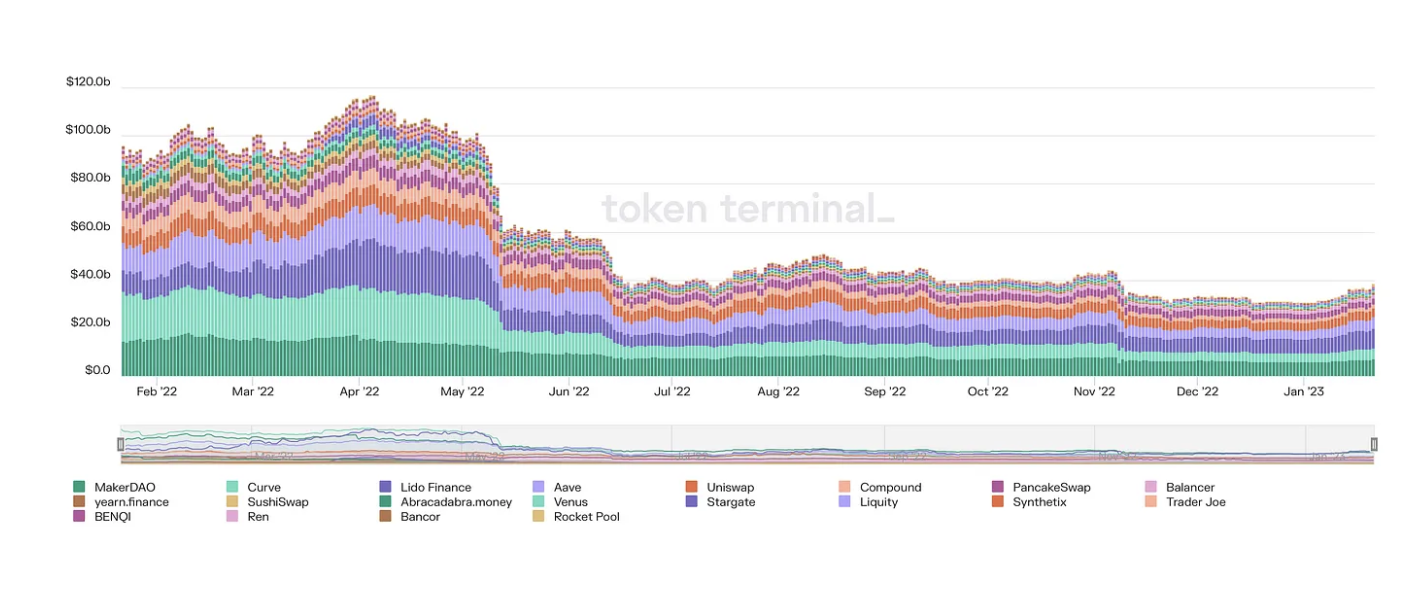

Cumulative TVL in the past 365 days

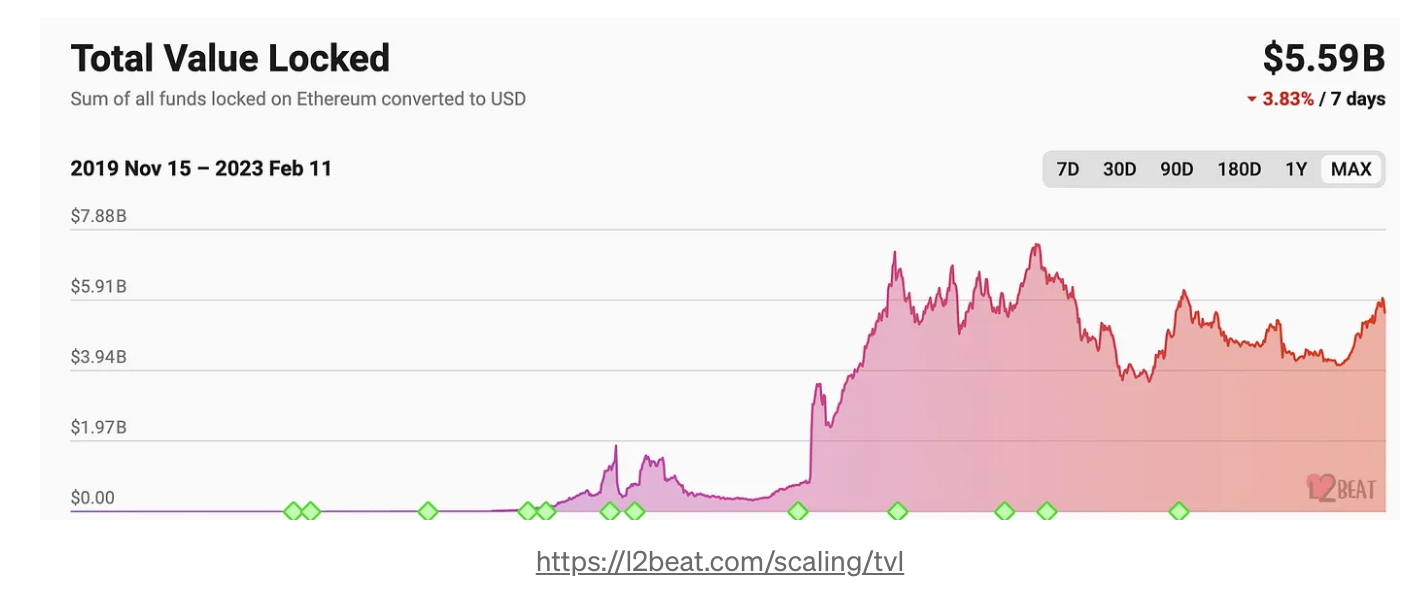

As we may notice, the TVL has significantly decreased in the past year which is associated with the huge outflow of capital, especially in the summer of 2022. Nevertheless, the TVL has stabilized since then, despite the market is still in decline.

As we may notice, the TVL has significantly decreased in the past year which is associated with the huge outflow of capital, especially in the summer of 2022. Nevertheless, the TVL has stabilized since then, despite the market is still in decline.

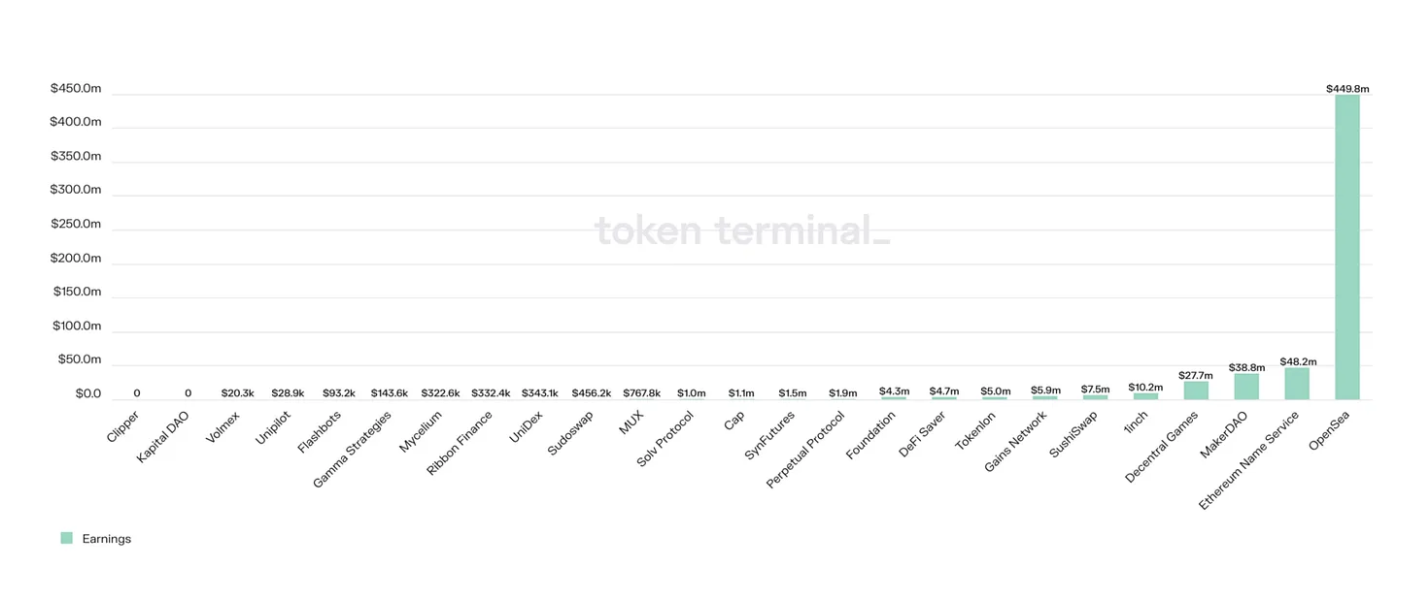

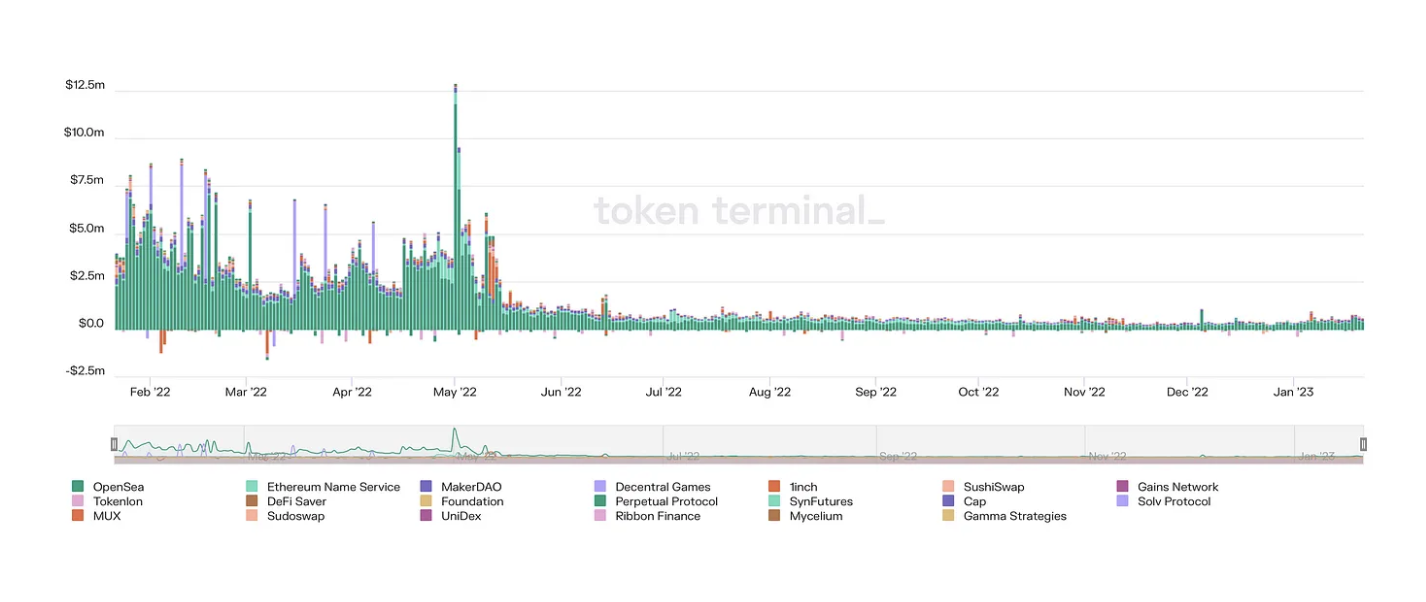

Daily cumulative earnings in the past 365 days

We could spot that cumulative earnings are quite low overall and have significantly dropped since May 2022. The only bright spot is Opensea, an absolute leader in terms of cumulative earnings heavily forging ahead of other dApps.

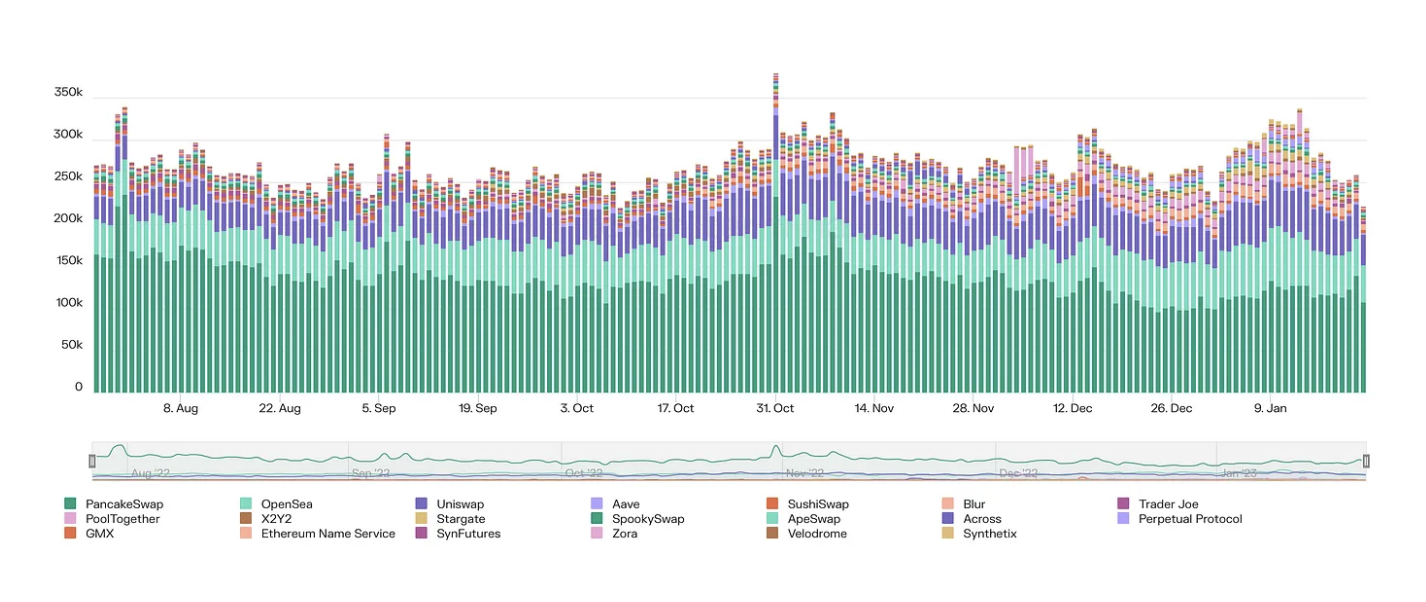

Daily active users in the past 180 days

From the metrics, we see that most of the users remain on core trading platforms: Uniswap, OpenSea, and PancakeSwap. The number of active users remains stable.

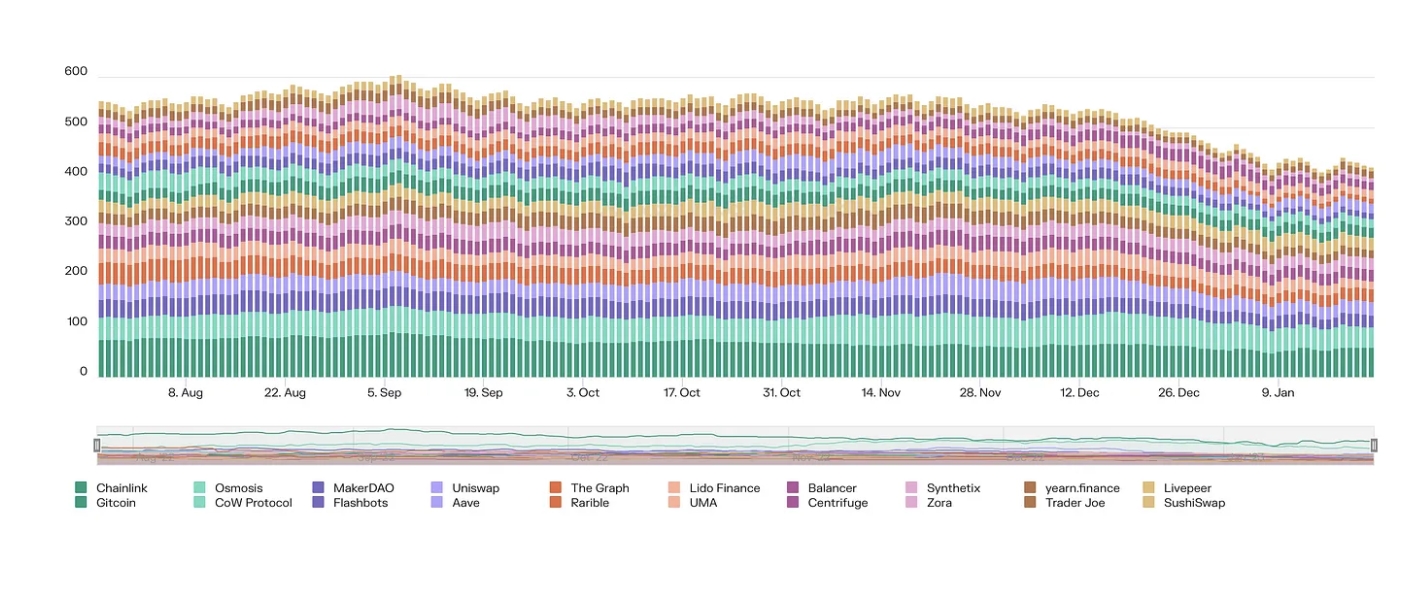

Daily active developers in the past 180 days

While all of the highlighted metrics above show a strong decline, developers remained active, showing only a slight decline by the end of 2022. Their activity is gradually distributed among various networks like Chainlink, Uniswap, etc.

While all of the highlighted metrics above show a strong decline, developers remained active, showing only a slight decline by the end of 2022. Their activity is gradually distributed among various networks like Chainlink, Uniswap, etc.

Key Milestones of 2022

ENS Spike

- 2022 was a record-breaking year for Ethereum Name Service (ENS). According to data, over 2.2 million ENS names were registered in 2022, which represents about 80% of all names that have been created in the protocol’s lifetime.

- The service recorded its highest number of new ‘.eth’ name registrations in September 2022 and also clinched major partnerships with crypto exchange Coinbase during the month.

- Additionally, the service recorded domain name registration spikes in May, July, and August due to gas fee drops. Also, the month with the highest number of primary name registrations was May 2022.

Uniswap stay strong

- Despite the overall crypto market declining by more than 50%, Uniswap’s trading volumes were only down 8.7% compared to the previous quarter.

- This is partly due to volatility being beneficial for DEXs, as they represent foundational infrastructure to the crypto economy, and users require their services when prices are volatile. Additionally, the activity of arbitrage bots in the system helped to drive trading activity.

Derivatives DEX-es are catching up.

- The total trading volume of decentralized derivatives exchanges reached $478B in the past 10 months, and the market size is expected to increase by more than 10 times within a year.

- dYdX, GMX, and Perpetual are the leading derivatives decentralized exchanges in the market and the next development direction for them is to provide more trading mechanisms, and products, and strive for market share.

Aggregation Protocols

- In Q4, FTX contagion shifted user behavior toward the Aggregation Protocol (AP).

- AP volumes remained relatively stable QoQ (-0.61%), but volumes on the Limit Order Protocol (LOP) decreased by 33% as more users sought to urgently execute market orders.

- The 1inch Foundation didn’t award any grants in Q4, but approximately $946,000 in 1INCH tokens have been distributed through grants in 2022

- Approximately 250 million 1INCH tokens, or ~17% of the total supply, were unlocked on December 1.

Chainlink integrations

- Despite the overall crypto market depression, Chainlink has had a busy year, expanding to various platforms and seeing strong demand for its oracles and price feeds on layer 2 platforms such as Arbitrum.

- It has also seen integrations with various other blockchains such as Avalanche, BNB Chain, Fantom, Gnosis Chain, Harmony, Metis, Moonbeam, Optimism, Polygon, and Solana, making it the industry standard for price oracles.

- The network also launched staking for its token, LINK, but its price has not yet reflected the positive developments. However, experts believe that the network’s solid fundamentals and real-world usage will lead to an increase in price in the future.

Trends for 2023

Artificial Intelligence

Image processors such as Midjourney and text generators as ChatGPT have sparked immense public interest. Unlike the promise of self-driving cars, these applications seem ready for real commercial deployment.

As we know right now, aside from digital cash, one of the clearest viable applications of blockchains is managing distributed computing resources. So far, blockchains have been used to incentivize and manage things such as distributed cloud storage (Filecoin) and distributed graphics compute (Render Network).

One technical detail here is worth emphasizing: Artificial intelligence cannot run “on” a blockchain. At least given current technology, this would be very slow and expensive. It’s hard to imagine how AI will be integrated into blockchain technology soon, but SingularityNet and similar crypto projects have their own approach. The answer for them is decentralized usage of off-chain AI technology. Just to confirm the trend, you can look at the price performance of SingularityNet token after Microsoft x ChatGPT $10B investment rumour.

One technical detail here is worth emphasizing: Artificial intelligence cannot run “on” a blockchain. At least given current technology, this would be very slow and expensive. It’s hard to imagine how AI will be integrated into blockchain technology soon, but SingularityNet and similar crypto projects have their own approach. The answer for them is decentralized usage of off-chain AI technology. Just to confirm the trend, you can look at the price performance of SingularityNet token after Microsoft x ChatGPT $10B investment rumour.

Move Ecosystem (SUI + Aptos)

Move programming language was created by the Diem Association, a tech consortium backed by Meta.

In simple terms, Move has several advantages over Solidity:

- Type Safety: Move is a statically typed language, meaning that type errors can be detected at compile time, making the code more secure and easier to maintain.

- Built-in Asset Handling: Move has built-in support for handling digital assets, making it easier for developers to write smart contracts that manage digital assets.

- Performance: Move is designed to be more performant than Solidity, which means that smart contracts written in Move can execute faster and handle more transactions per second.

Overall, Move is designed to be a more modern, efficient, and secure programming language for writing smart contracts, compared to Solidity.

There are currently 2 big projects that are building on Move language:

Aptos & SUI:

Aptos mainnet was launched on 12th of October. Ecosystem TVL stands on $61M. While testenet metrics of tps and number of validators were way better than current mainnet numbers, it’s still worth monitoring the development of Aptos, as it is backed by almost all top tier web3 investors.

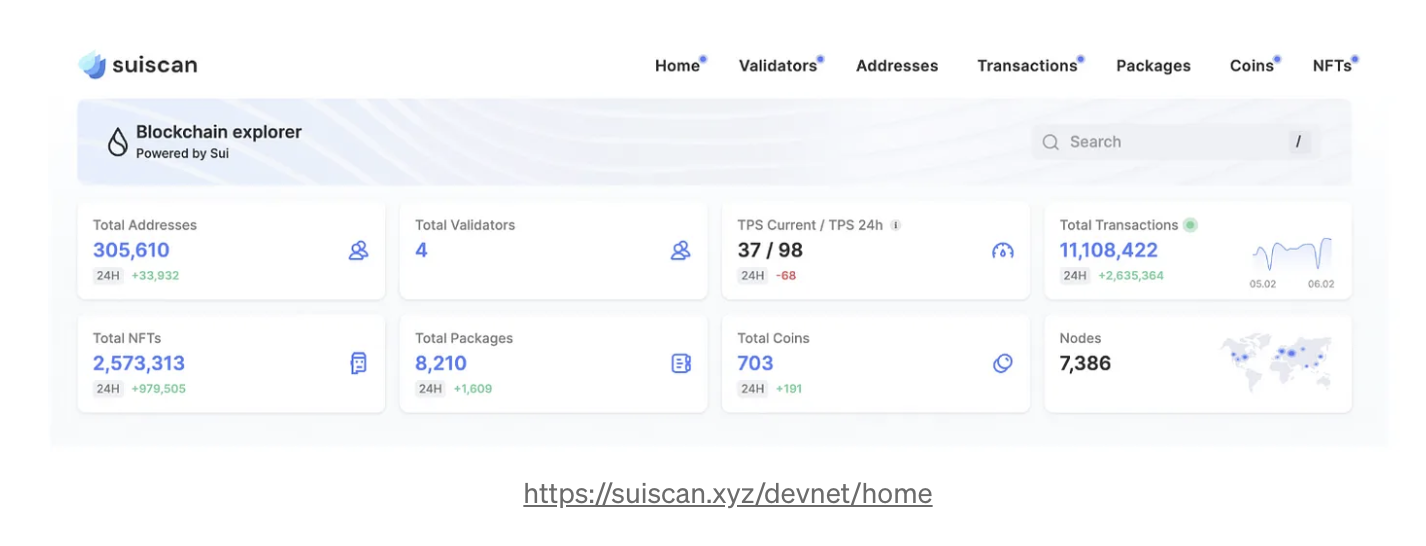

SUI is preparing to launch on mainnet somewhere in Q1,Q2 2023. Currently, they are running the 2nd phase of testnet. And the numbers of activity are astonishing.

Ethereum Scaling Solutions

You probably heard that transactions on Ethereum are quite expensive, especially during bull markets and relatively slow transaction speed, around 20 tps. Scaling solutions are aiming to increase the speed of transactions and decrease fees, so more people will be able to use the technology. Currently, the total value locked across Ethereum scaling solutions stands at around $5.6B.

You probably heard that transactions on Ethereum are quite expensive, especially during bull markets and relatively slow transaction speed, around 20 tps. Scaling solutions are aiming to increase the speed of transactions and decrease fees, so more people will be able to use the technology. Currently, the total value locked across Ethereum scaling solutions stands at around $5.6B.

Here are some updates from 2022.

Polygon:

Arbitrum:

Polygon:

- Hits 200 million addresses.

- Reddit’s digital collectibles.

- Meta’s Instagram NFT integration.

- The network’s native cryptocurrency MATIC just kicked off the year by entering into the list of the top 10 most purchased tokens among the 100 biggest ETH whales

Arbitrum:

- Arbitrum Nova, a chain dedicated to social and gaming applications!

- Nitro upgrade to Arbitrum One.

- OpenSea on Arbitrum.

- The total value of assets held on Optimism increased 10x., going from 116k ETH to 995k ETH in the same 12 month period.

- Added 54 new dApps.

- Meanwhile, 155k wallets are currently delegating 22.9M OP in governance.

Subscribe to our social media channels for more insightful market reports